Summary

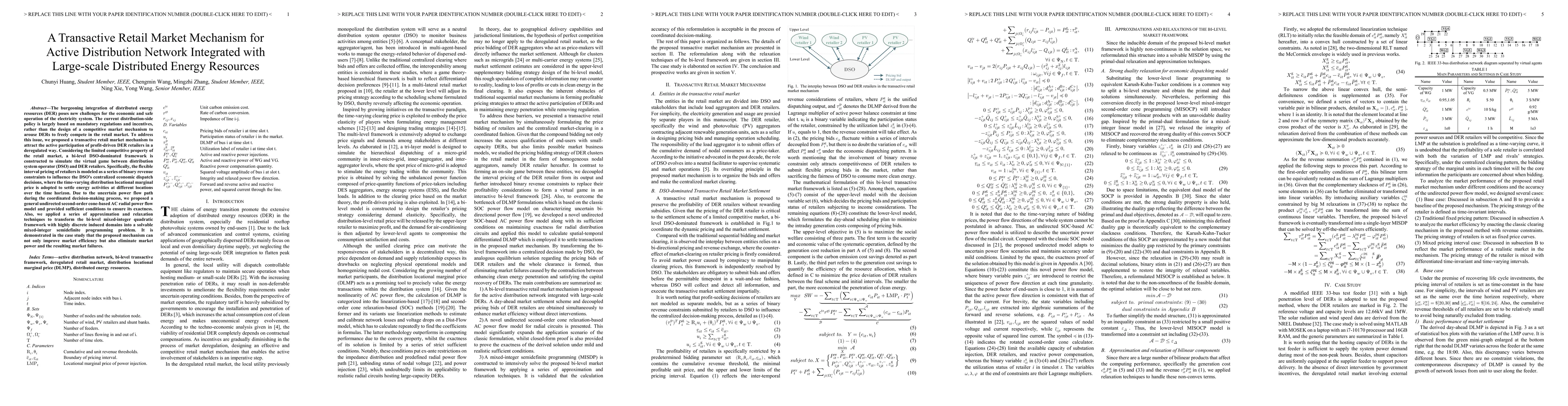

The burgeoning integration of distributed energy resources (DER) poses new challenges for the economic and safe operation of the electricity system. The current distribution-side policy is largely based on mandatory regulations and incentives, rather than the design of a competitive market mechanism to arouse DERs to freely compete in the retail market. To address this issue, we proposed a transactive retail market mechanism to attract the active participation of profit-driven DER retailers in a deregulated way. Considering the limited competitive property of the retail market, a bi-level DSO-dominated framework is constructed to simulate the virtual game between distribution system operator (DSO) and DER retailers. Specifically, the flexible interval pricing of retailers is modeled as a series of binary revenue constraints to influence the DSO's centralized economic dispatch decisions, where the time-varying distribution locational marginal price is adopted to settle energy activities at different locations over the time horizon. Due to the uncertain power flow path during the coordinated decision-making process, we proposed a general undirected second-order cone-based AC radial power flow model and provided sufficient conditions to ensure its exactness. Also, we applied a series of approximation and relaxation techniques to transform the bi-level mixed-integer quadratic framework with highly discrete induced domains into a solvable mixed-integer semidefinite programming problem. It is demonstrated in the case study that the proposed mechanism can not only improve market efficiency but also eliminate market power and the resulting market failures.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Real-Time Limit Order Book as a Market Mechanism for Transactive Energy Systems

David P. Chassin, Akshay Sreekumar, Adhithyan Sakthivelu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)