Authors

Summary

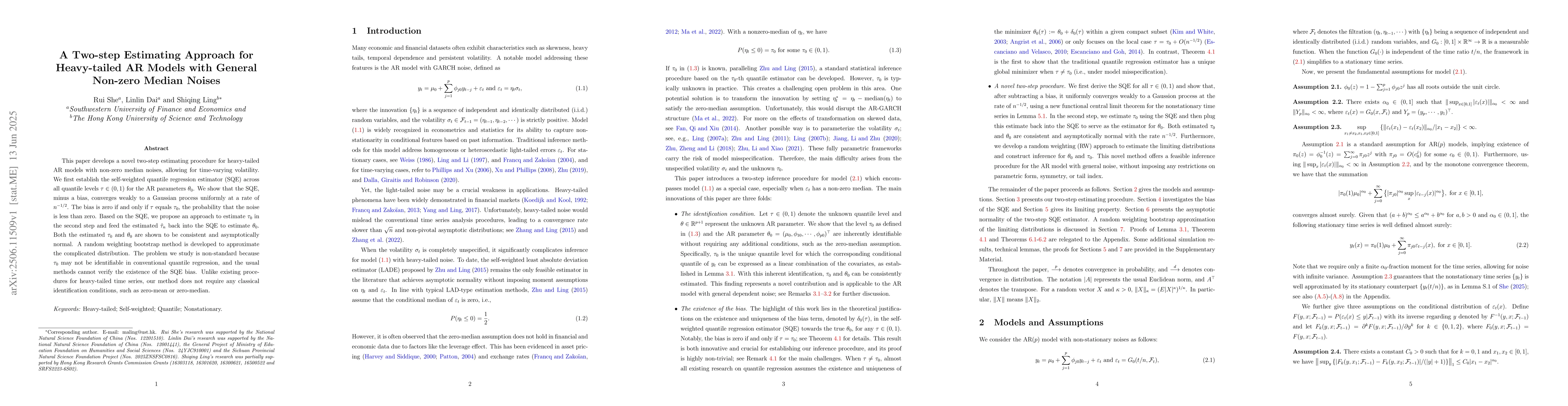

This paper develops a novel two-step estimating procedure for heavy-tailed AR models with non-zero median noises, allowing for time-varying volatility. We first establish the self-weighted quantile regression estimator (SQE) across all quantile levels $\tau\in (0,1)$ for the AR parameters $\theta_{0}$. We show that the SQE, minus a bias, converges weakly to a Gaussian process uniformly at a rate of $n^{-1/2}$. The bias is zero if and only if $\tau$ equals $\tau_{0}$, the probability that the noise is less than zero. Based on the SQE, we propose an approach to estimate $\tau_{0}$ in the second step and {feed the estimated $\hat{\tau}_n$ back into the SQE to estimate $\theta_0$.} Both the estimated $\tau_{0}$ and $\theta_{0}$ are shown to be consistent and asymptotically normal. A random weighting bootstrap method is developed to approximate the complicated distribution. The problem we study is non-standard because $\tau_{0}$ may not be identifiable in conventional quantile regression, and the usual methods cannot verify the existence of the SQE bias. Unlike existing procedures for heavy-tailed time series, our method does not require any classical identification conditions, such as zero-mean or zero-median.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersStochastic Weakly Convex Optimization Under Heavy-Tailed Noises

Xiangyang Ji, Yi Xu, Tianxi Zhu

Sparse Linear Regression when Noises and Covariates are Heavy-Tailed and Contaminated by Outliers

Takeyuki Sasai, Hironori Fujisawa

No citations found for this paper.

Comments (0)