Summary

This paper concerns asynchrony in iterative processes, focusing on gradient descent and tatonnement, a fundamental price dynamic. Gradient descent is an important class of iterative algorithms for minimizing convex functions. Classically, gradient descent has been a sequential and synchronous process, although distributed and asynchronous variants have been studied since the 1980s. Coordinate descent is a commonly studied version of gradient descent. In this paper, we focus on asynchronous coordinate descent on convex functions $F:\mathbb{R}^n\rightarrow\mathbb{R}$ of the form $F(x) = f(x) + \sum_{k=1}^n \Psi_k(x_k)$, where $f:\mathbb{R}^n\rightarrow\mathbb{R}$ is a smooth convex function, and each $\Psi_k:\mathbb{R}\rightarrow\mathbb{R}$ is a univariate and possibly non-smooth convex function. Such functions occur in many data analysis and machine learning problems. We give new analyses of cyclic coordinate descent, a parallel asynchronous stochastic coordinate descent, and a rather general worst-case parallel asynchronous coordinate descent. For all of these, we either obtain sharply improved bounds, or provide the first analyses. Our analyses all use a common amortized framework. The application of this framework to the asynchronous stochastic version requires some new ideas, for it is not obvious how to ensure a uniform distribution where it is needed in the face of asynchronous actions that may undo uniformity. We believe that our approach may well be applicable to the analysis of other iterative asynchronous stochastic processes. We extend the framework to show that an asynchronous version of tatonnement, a fundamental price dynamic widely studied in general equilibrium theory, converges toward a market equilibrium for Fisher markets with CES utilities or Leontief utilities, for which tatonnement is equivalent to coordinate descent.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

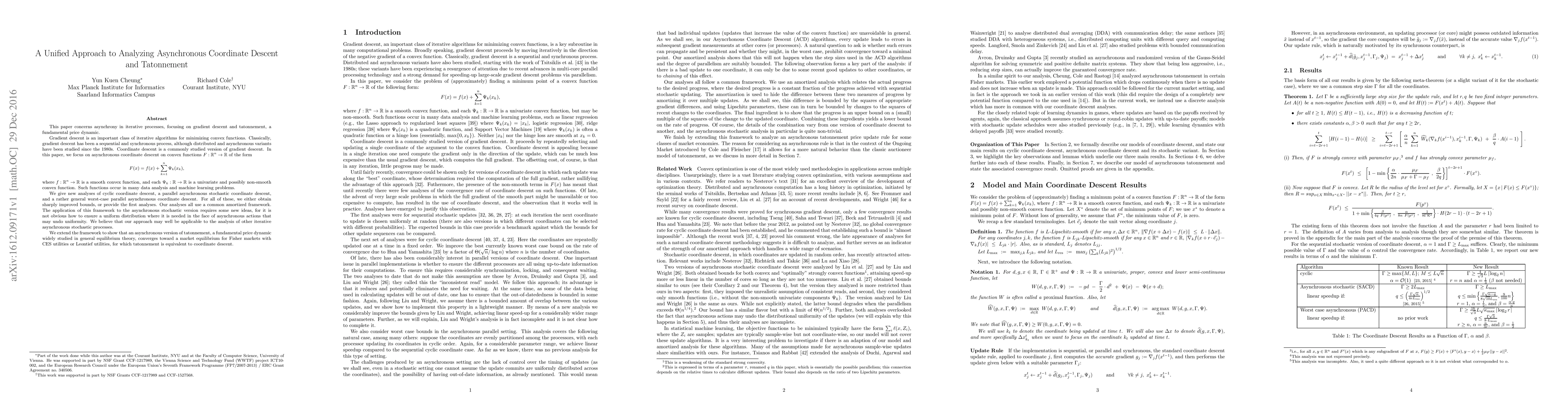

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)