Summary

In this paper, we review pricing of variable annuity living and death guarantees offered to retail investors in many countries. Investors purchase these products to take advantage of market growth and protect savings. We present pricing of these products via an optimal stochastic control framework, and review the existing numerical methods. For numerical valuation of these contracts, we develop a direct integration method based on Gauss-Hermite quadrature with a one-dimensional cubic spline for calculation of the expected contract value, and a bi-cubic spline interpolation for applying the jump conditions across the contract cashflow event times. This method is very efficient when compared to the partial differential equation methods if the transition density (or its moments) of the risky asset underlying the contract is known in closed form between the event times. We also present accurate numerical results for pricing of a Guaranteed Minimum Accumulation Benefit (GMAB) guarantee available on the market that can serve as a benchmark for practitioners and researchers developing pricing of variable annuity guarantees.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

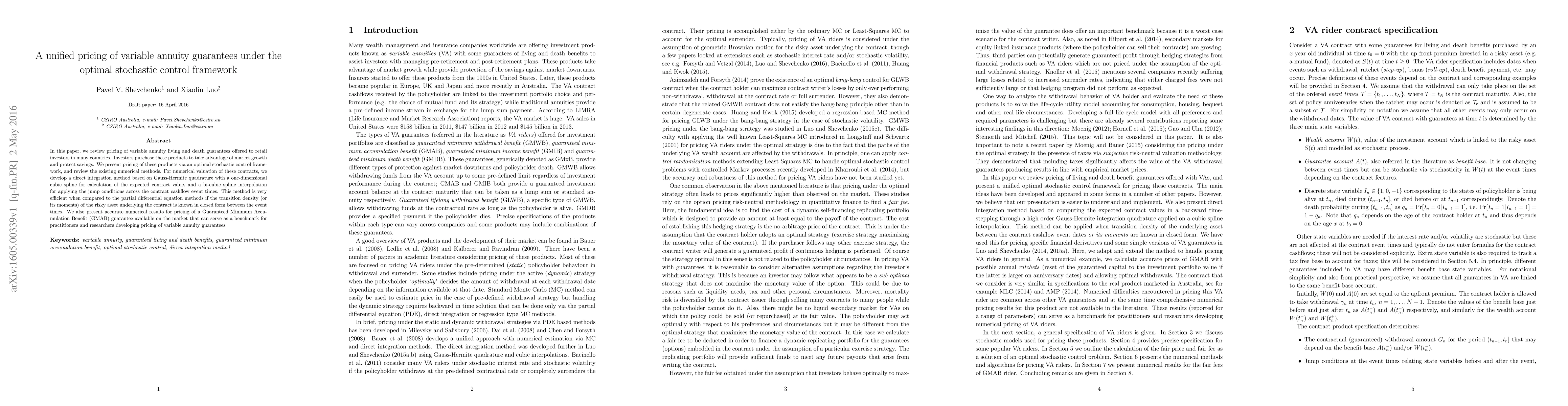

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)