Authors

Summary

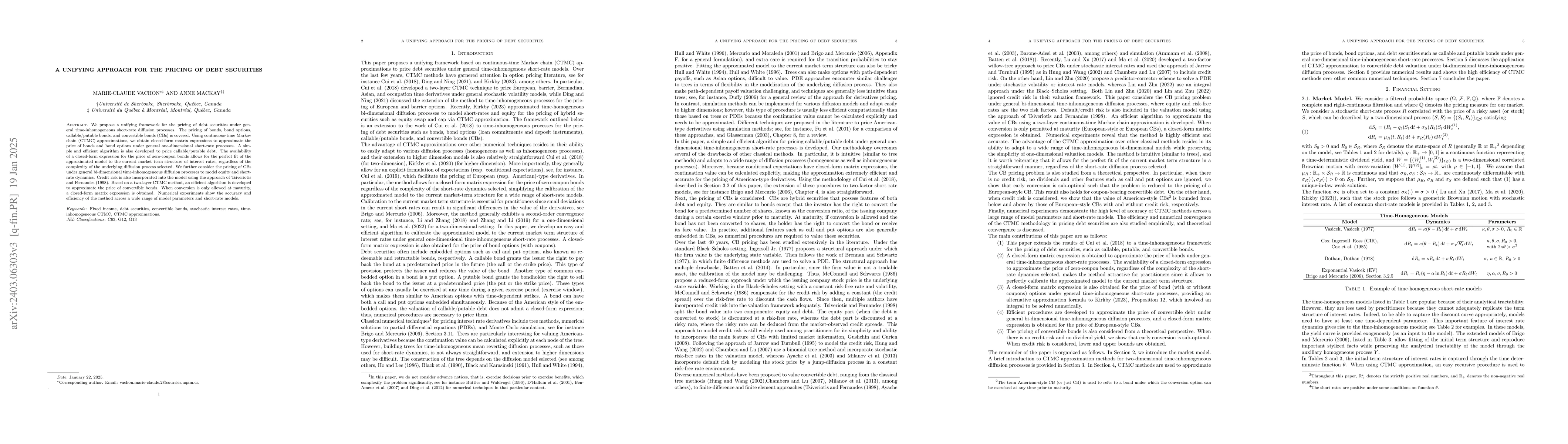

We propose a unifying framework for the pricing of debt securities under general time-inhomogeneous short-rate diffusion processes. The pricing of bonds, bond options, callable/putable bonds, and convertible bonds (CBs) are covered. Using continuous-time Markov chain (CTMC) approximation, we obtain closed-form matrix expressions to approximate the price of bonds and bond options under general one-dimensional short-rate processes. A simple and efficient algorithm is also developed to price callable/putable debts. The availability of a closed-form expression for the price of zero-coupon bonds allows for the perfect fit of the approximated model to the current market term structure of interest rates, regardless of the complexity of the underlying diffusion process selected. We further consider the pricing of CBs under general bi-dimensional time-inhomogeneous diffusion processes to model equity and short-rate dynamics. Credit risk is also incorporated into the model using the approach of Tsiveriotis and Fernandes (1998). Based on a two-layer CTMC method, an efficient algorithm is developed to approximate the price of convertible bonds. When conversion is only allowed at maturity, a closed-form matrix expression is obtained. Numerical experiments show the accuracy and efficiency of the method across a wide range of model parameters and short-rate models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)