Summary

To improve the efficient frontier of the classical mean-variance model in continuous time, we propose a varying terminal time mean-variance model with a constraint on the mean value of the portfolio asset, which moves with the varying terminal time. Using the embedding technique from stochastic optimal control in continuous time and varying the terminal time, we determine an optimal strategy and related deterministic terminal time for the model. Our results suggest that doing so for an investment plan requires minimizing the variance with a varying terminal time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

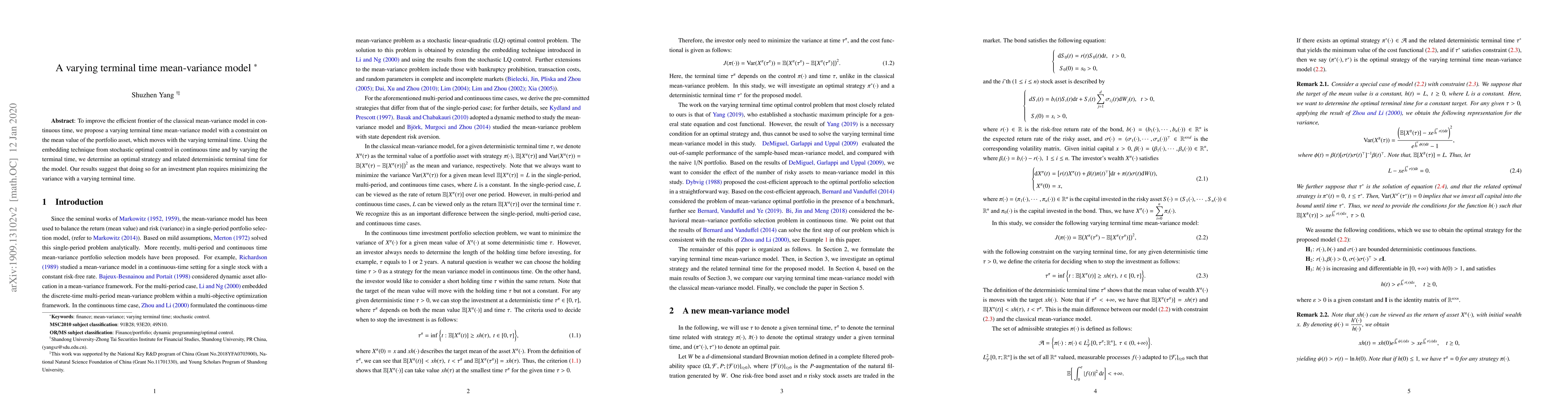

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)