Summary

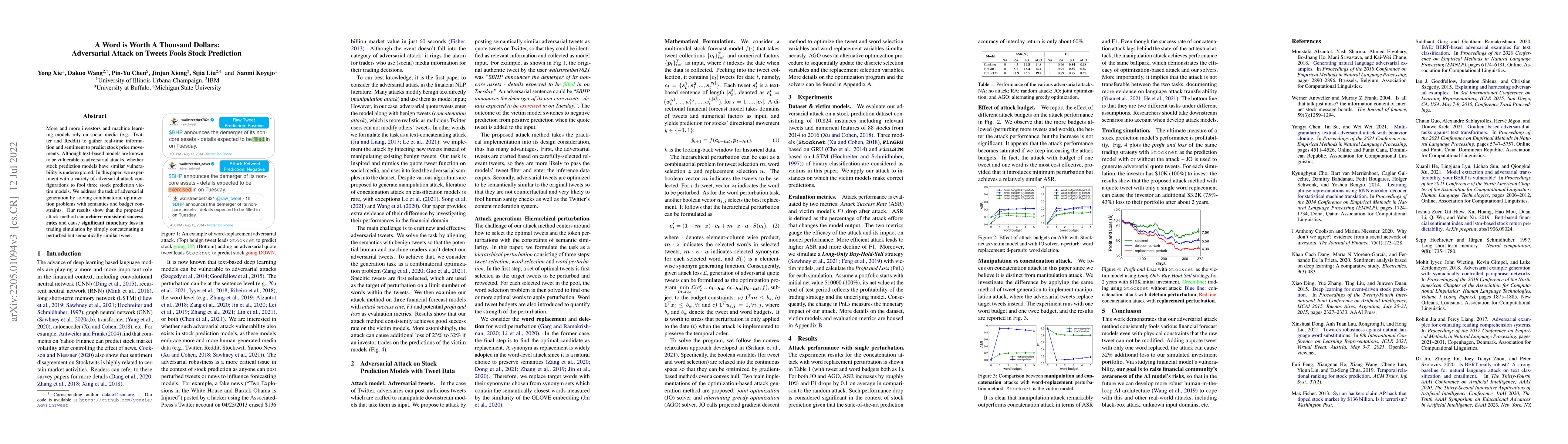

More and more investors and machine learning models rely on social media (e.g., Twitter and Reddit) to gather real-time information and sentiment to predict stock price movements. Although text-based models are known to be vulnerable to adversarial attacks, whether stock prediction models have similar vulnerability is underexplored. In this paper, we experiment with a variety of adversarial attack configurations to fool three stock prediction victim models. We address the task of adversarial generation by solving combinatorial optimization problems with semantics and budget constraints. Our results show that the proposed attack method can achieve consistent success rates and cause significant monetary loss in trading simulation by simply concatenating a perturbed but semantically similar tweet.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Modified Word Saliency-Based Adversarial Attack on Text Classification Models

Hetvi Waghela, Jaydip Sen, Sneha Rakshit

A Simple Yet Efficient Method for Adversarial Word-Substitute Attack

Yi Yang, Tianle Li

A Word is Worth a Thousand Pictures: Prompts as AI Design Material

Minsuk Chang, Michael Terry, Stefania Druga et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)