Summary

In the present paper, we study a two-player zero-sum deterministic differential game with both players adopting impulse controls, in infinite time horizon, under rather weak assumptions on the cost functions. We prove by means of the dynamic programming principle (DPP) that the lower and upper value functions are continuous and viscosity solutions to the corresponding Hamilton-Jacobi-Bellman-Isaacs (HJBI) quasi-variational inequality (QVI). We define a new HJBI QVI for which, under a proportional property assumption on the maximizer cost, the value functions are the unique viscosity solution. We then prove that the lower and upper value functions coincide.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

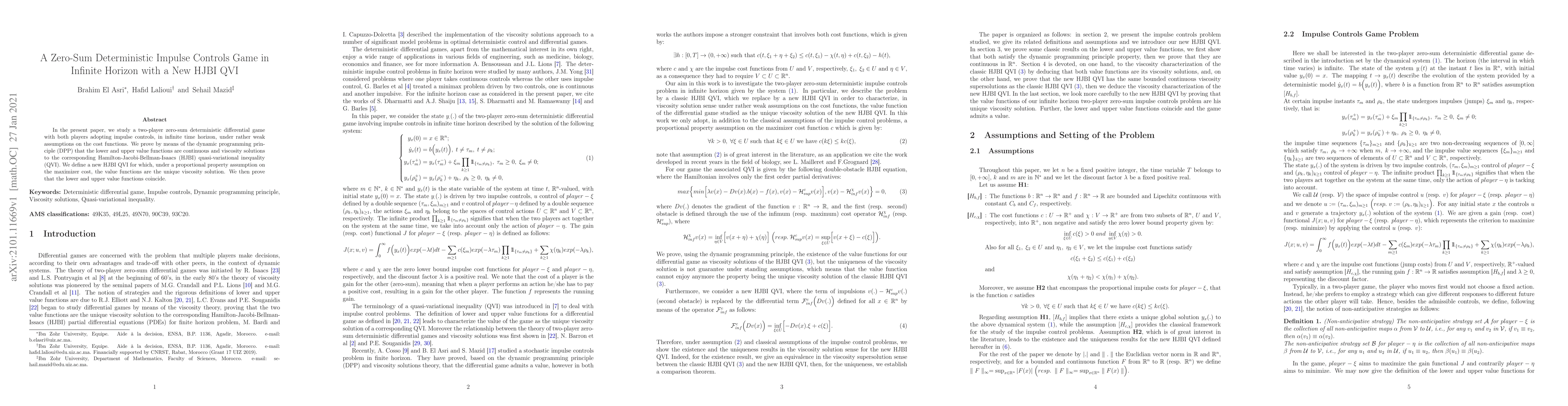

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeterministic Differential Games in Infinite Horizon Involving Continuous and Impulse Controls

Brahim El Asri, Hafid Lalioui

Numerical approximations of the value of zero-sum stochastic differential impulse controls game in finite horizon

Antoine Zolome, Brahim El Asri

Continuous and Impulse Controls Differential Game in Finite Horizon with Nash-Equilibrium and Application

Brahim El Asri, Hafid Lalioui

| Title | Authors | Year | Actions |

|---|

Comments (0)