Summary

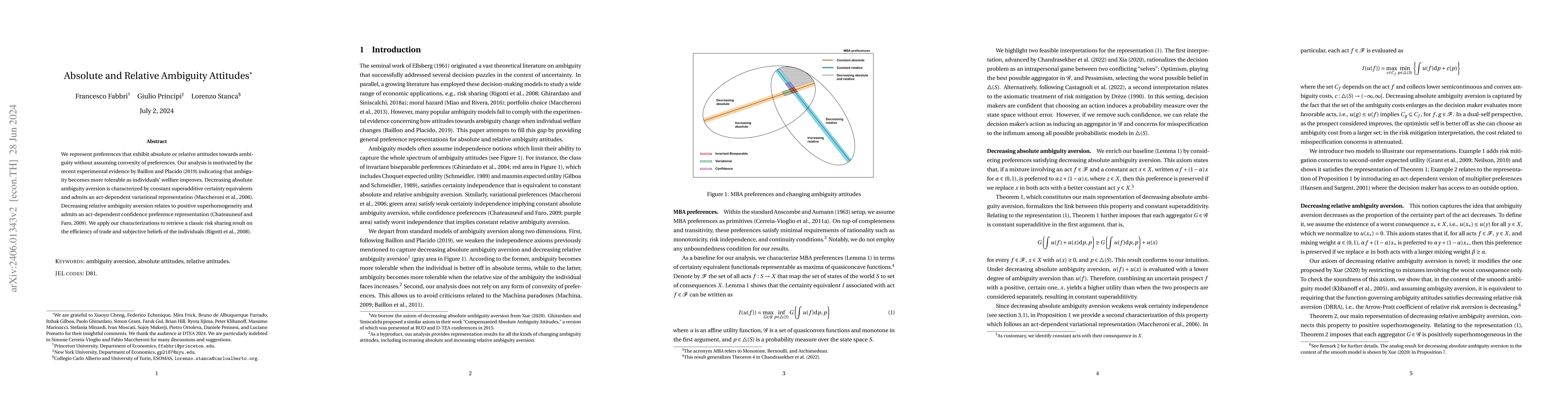

We represent preferences that exhibit absolute or relative attitudes towards ambiguity without assuming convexity of preferences. Our analysis is motivated by the recent experimental evidence by Baillon and Placido (2019) indicating that ambiguity becomes more tolerable as individuals are better off overall. Decreasing absolute ambiguity aversion is characterized by constant superadditive certainty equivalents and admits an act-dependent variational representation (Maccheroni et al., 2006). Decreasing relative ambiguity aversion relates to positive superhomogeneity and admits an act-dependent confidence preference representation (Chateauneuf and Faro, 2009). We apply our characterizations to retrieve a classic risk sharing result on the efficiency of trade and subjective beliefs of the individuals (Rigotti et al., 2008).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRecursive Preferences and Ambiguity Attitudes

Giulio Principi, Lorenzo Stanca, Massimo Marinacci

Higher-Order Ambiguity Attitudes

Roger J. A. Laeven, Mitja Stadje, Mücahit Aygün

Feeling Optimistic? Ambiguity Attitudes for Online Decision Making

Yu Gu, Jared J. Beard, R. Michael Butts

| Title | Authors | Year | Actions |

|---|

Comments (0)