Summary

We prove that the standard discrete-time accelerator equation cannot be considered as an exact discrete analog of the continuous-time accelerator equation. This leads to fact that the standard discrete-time macroeconomic models cannot be considered as exact discretization of the corresponding continuous-time models. As a result, the equations of the continuous and standard discrete models have different solutions and can predict the different behavior of the economy. In this paper, we propose a self-consistent discrete-time description of the economic accelerators that is based on the exact finite differences. For discrete-time approach, the model equations with exact differences have the same solutions as the corresponding continuous-time models and these discrete and continuous models describe the same behavior of the economy. Using the Harrod-Domar growth model as an example, we show that equations of the continuous-time model and the suggested exact discrete model have the same solutions and these models predict the same behavior of the economy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

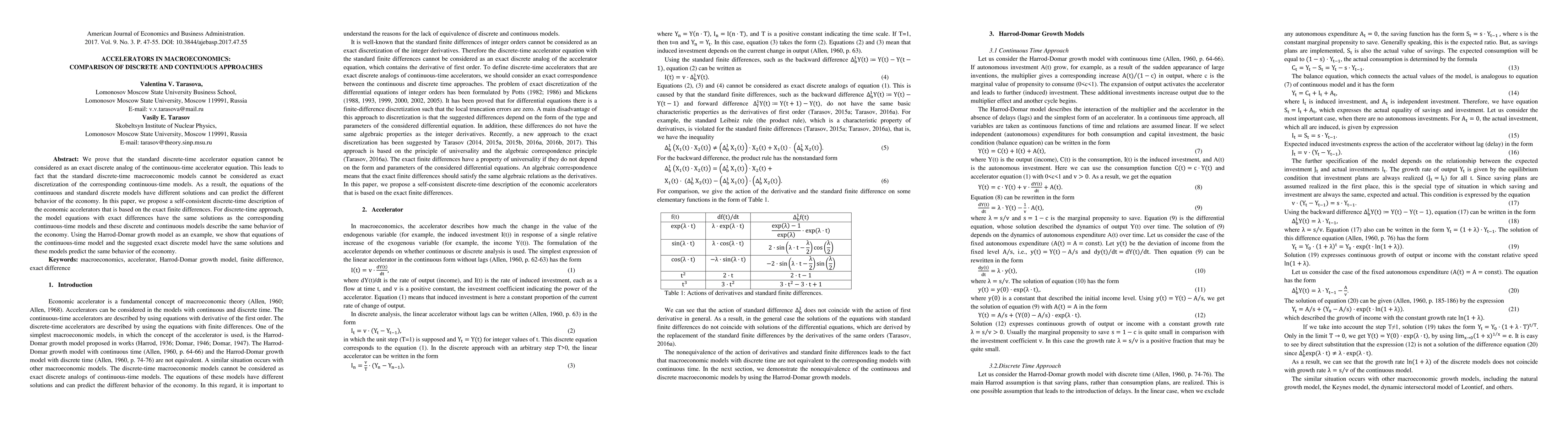

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)