Summary

In this paper, we consider a risk-averse decision problem for controlled-diffusion processes, with dynamic risk measures, in which multiple risk-averse agents choose their decisions in such a way to minimize their individual accumulated risk-costs over a finite-time horizon. In particular, we introduce multi-structure dynamic risk measures induced from conditional $g$-expectations, where the latter are associated with the generator functionals of certain BSDEs that implicitly take into account the risk-cost functionals of the risk-averse agents. Here, we also require that such solutions of the BSDEs to satisfy a stochastic viability property with respect to a given closed convex set. Moreover, using a result similar to that of the Arrow-Barankin-Blackwell theorem, we establish the existence of consistent optimal decisions for the risk-averse agents, when the set of all Pareto optimal solutions, in the sense of viscosity, for the associated dynamic programming equations is dense in the given closed convex set. Finally, we briefly comment on the characteristics of acceptable risks vis-\'{a}-vis some uncertain future costs or outcomes, in which results from the dynamic risk analysis constitute part of the information used in the risk-averse decision criteria.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

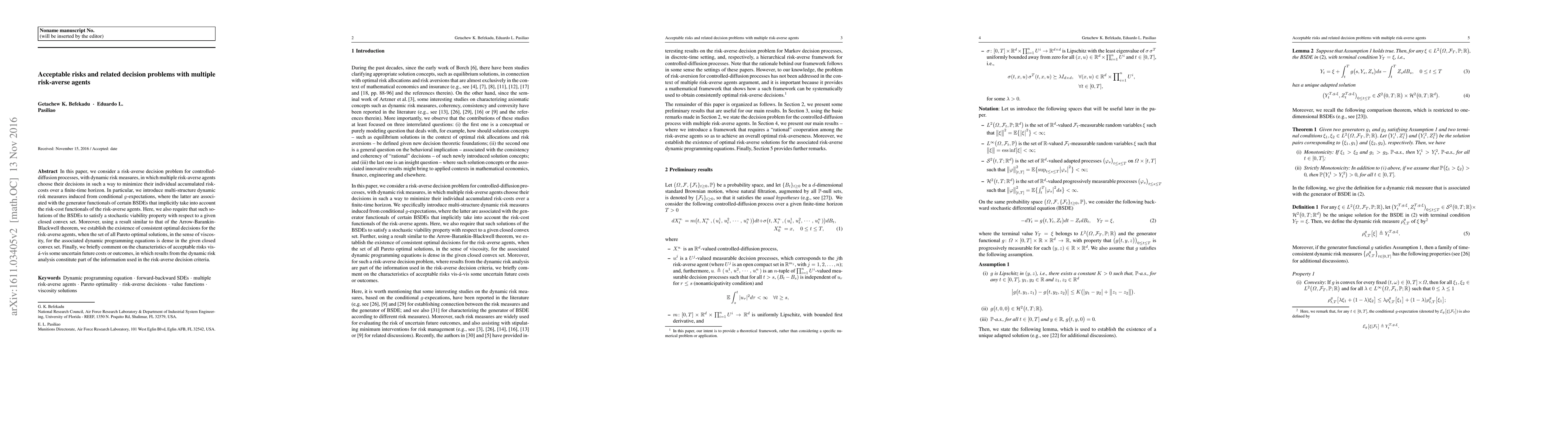

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDecision Theoretic Foundations for Conformal Prediction: Optimal Uncertainty Quantification for Risk-Averse Agents

Hamed Hassani, Shayan Kiyani, George Pappas et al.

No citations found for this paper.

Comments (0)