Summary

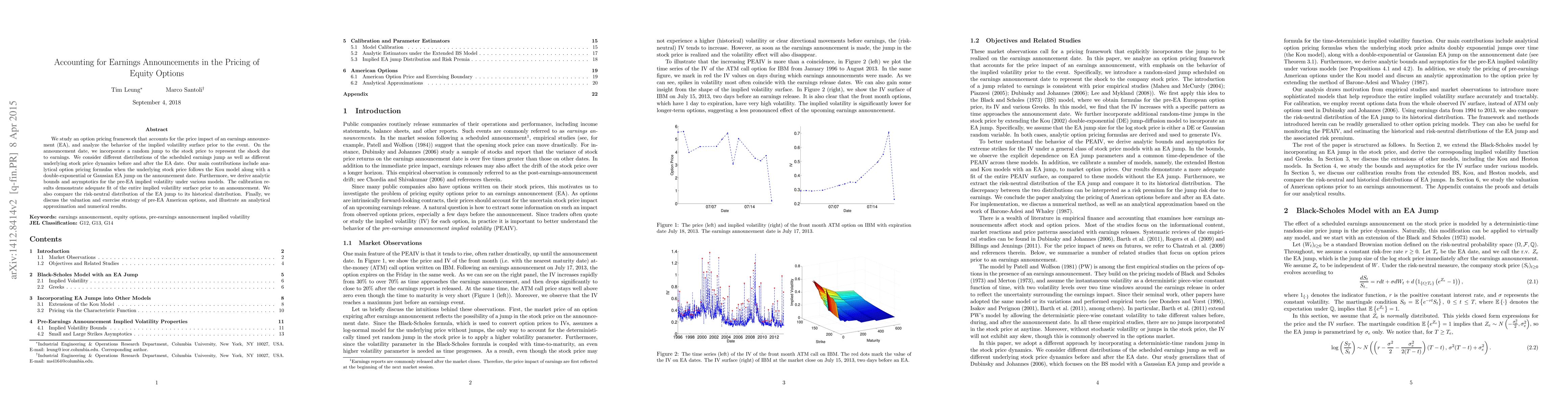

We study an option pricing framework that accounts for the price impact of an earnings announcement (EA), and analyze the behavior of the implied volatility surface prior to the event. On the announcement date, we incorporate a random jump to the stock price to represent the shock due to earnings. We consider different distributions of the scheduled earnings jump as well as different underlying stock price dynamics before and after the EA date. Our main contributions include analytical option pricing formulas when the underlying stock price follows the Kou model along with a double-exponential or Gaussian EA jump on the announcement date. Furthermore, we derive analytic bounds and asymptotics for the pre-EA implied volatility under various models. The calibration results demonstrate adequate fit of the entire implied volatility surface prior to an announcement. We also compare the risk-neutral distribution of the EA jump to its historical distribution. Finally, we discuss the valuation and exercise strategy of pre-EA American options, and illustrate an analytical approximation and numerical results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMedia abnormal tone, earnings announcements, and the stock market

David Ardia, Keven Bluteau, Kris Boudt

| Title | Authors | Year | Actions |

|---|

Comments (0)