Summary

Shrinkage for time-varying parameter (TVP) models is investigated within a Bayesian framework, with the aim to automatically reduce time-varying parameters to static ones, if the model is overfitting. This is achieved through placing the double gamma shrinkage prior on the process variances. An efficient Markov chain Monte Carlo scheme is developed, exploiting boosting based on the ancillarity-sufficiency interweaving strategy. The method is applicable both to TVP models for univariate as well as multivariate time series. Applications include a TVP generalized Phillips curve for EU area inflation modelling and a multivariate TVP Cholesky stochastic volatility model for joint modelling of the returns from the DAX-30 index.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

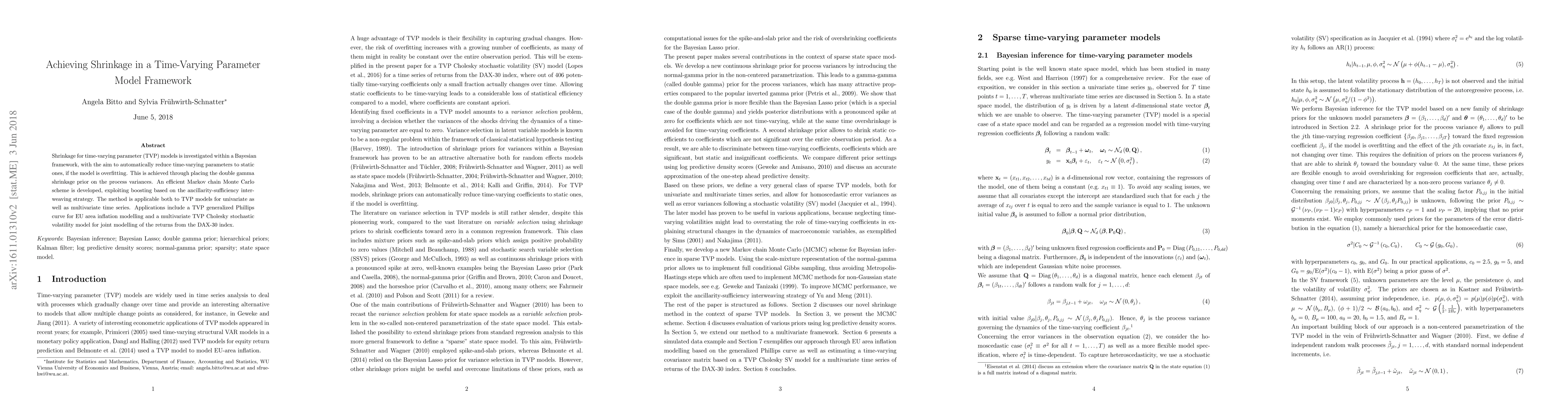

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Dynamic Triple Gamma Prior as a Shrinkage Process Prior for Time-Varying Parameter Models

Peter Knaus, Sylvia Frühwirth-Schnatter

| Title | Authors | Year | Actions |

|---|

Comments (0)