Summary

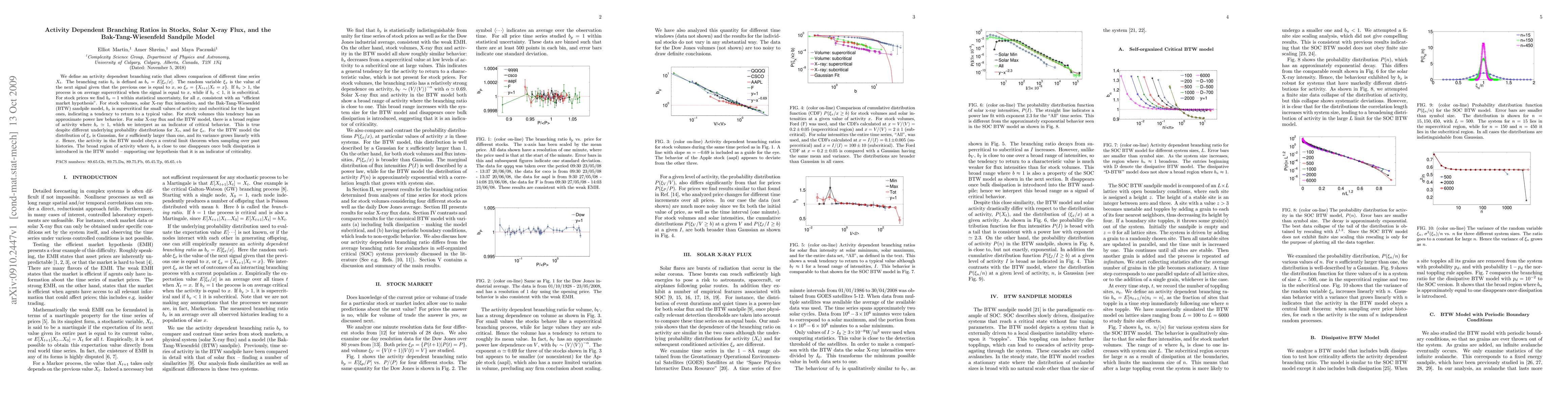

We define an activity dependent branching ratio that allows comparison of different time series $X_{t}$. The branching ratio $b_x$ is defined as $b_x= E[\xi_x/x]$. The random variable $\xi_x$ is the value of the next signal given that the previous one is equal to $x$, so $\xi_x=\{X_{t+1}|X_t=x\}$. If $b_x>1$, the process is on average supercritical when the signal is equal to $x$, while if $b_x<1$, it is subcritical. For stock prices we find $b_x=1$ within statistical uncertainty, for all $x$, consistent with an ``efficient market hypothesis''. For stock volumes, solar X-ray flux intensities, and the Bak-Tang-Wiesenfeld (BTW) sandpile model, $b_x$ is supercritical for small values of activity and subcritical for the largest ones, indicating a tendency to return to a typical value. For stock volumes this tendency has an approximate power law behavior. For solar X-ray flux and the BTW model, there is a broad regime of activity where $b_x \simeq 1$, which we interpret as an indicator of critical behavior. This is true despite different underlying probability distributions for $X_t$, and for $\xi_x$. For the BTW model the distribution of $\xi_x$ is Gaussian, for $x$ sufficiently larger than one, and its variance grows linearly with $x$. Hence, the activity in the BTW model obeys a central limit theorem when sampling over past histories. The broad region of activity where $b_x$ is close to one disappears once bulk dissipation is introduced in the BTW model -- supporting our hypothesis that it is an indicator of criticality.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)