Summary

We present a constructive approach to Bernstein copulas with an admissible discrete skeleton in arbitrary dimensions when the underlying marginal grid sizes are smaller than the number of observations. This prevents an overfitting of the estimated dependence model and reduces the simulation effort for Bernstein copulas a lot. In a case study, we compare different approaches of Bernstein and Gaussian copulas w.r.t. the estimation of risk measures in risk management.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

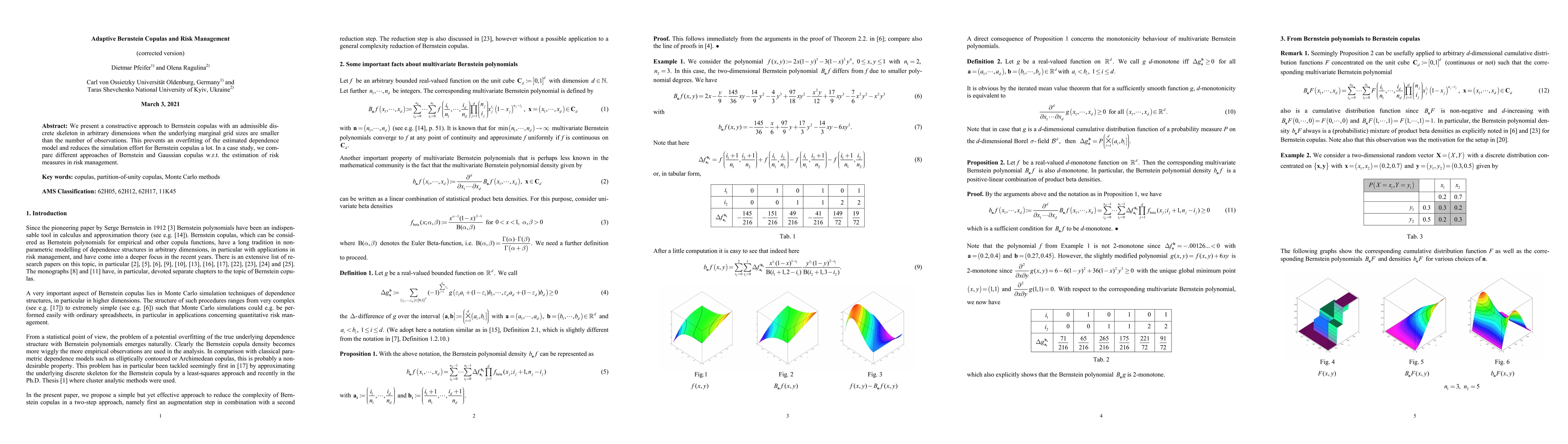

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTesting Symmetry for Bivariate Copulas using Bernstein Polynomials

Guanjie Lyu, Mohamed Belalia

| Title | Authors | Year | Actions |

|---|

Comments (0)