Summary

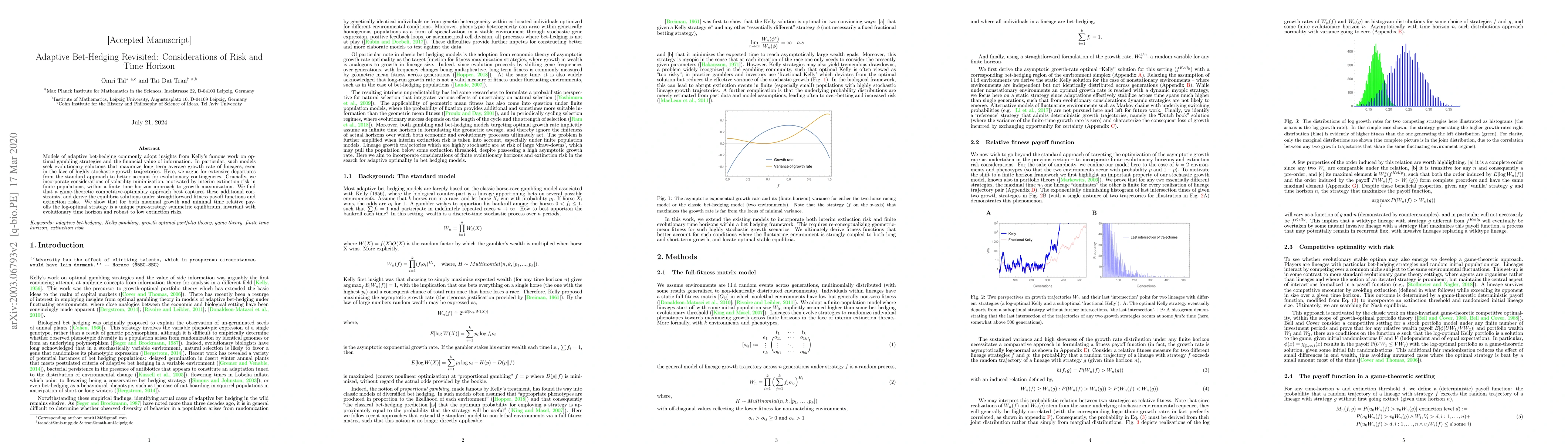

Models of adaptive bet-hedging commonly adopt insights from Kelly's famous work on optimal gambling strategies and the financial value of information. In particular, such models seek evolutionary solutions that maximize long term average growth rate of lineages, even in the face of highly stochastic growth trajectories. Here, we argue for extensive departures from the standard approach to better account for evolutionary contingencies. Crucially, we incorporate considerations of volatility minimization, motivated by interim extinction risk in finite populations, within a finite time horizon approach to growth maximization. We find that a game-theoretic competitive-optimality approach best captures these additional constraints, and derive the equilibria solutions under straightforward fitness payoff functions and extinction risks. We show that for both maximal growth and minimal time relative payoffs the log-optimal strategy is a unique pure-strategy symmetric equilibrium, invariant with evolutionary time horizon and robust to low extinction risks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAdaptive hedging horizon and hedging performance estimation

Qing Han, Junpeng Di, Wang Haoyu

Extinction in agent-based and collective models of bet-hedging

Manuel Dávila-Romero, Francisco J. Cao-García, Luis Dinis

| Title | Authors | Year | Actions |

|---|

Comments (0)