Authors

Summary

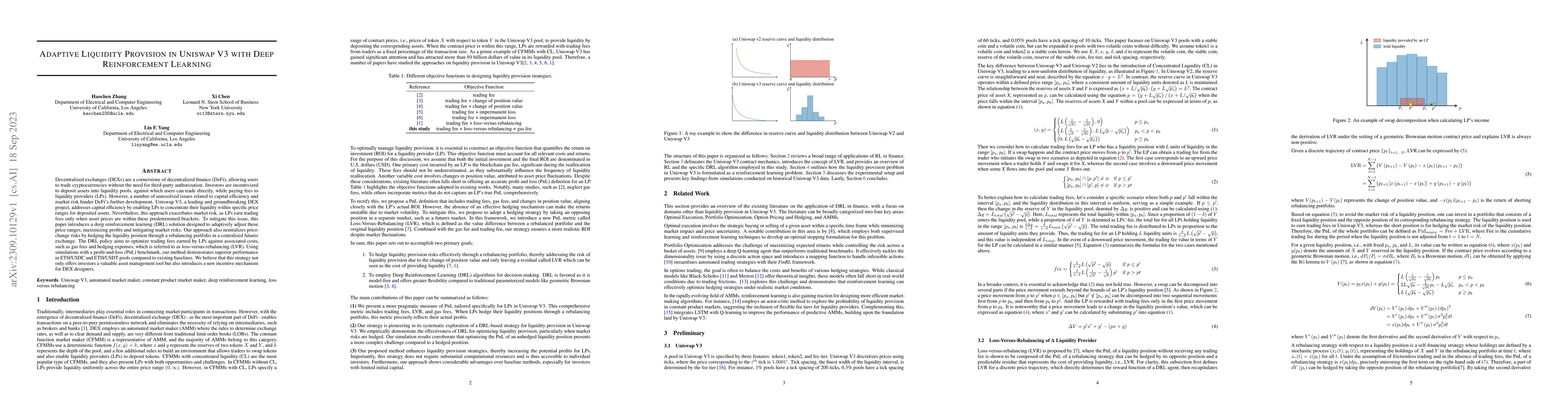

Decentralized exchanges (DEXs) are a cornerstone of decentralized finance (DeFi), allowing users to trade cryptocurrencies without the need for third-party authorization. Investors are incentivized to deposit assets into liquidity pools, against which users can trade directly, while paying fees to liquidity providers (LPs). However, a number of unresolved issues related to capital efficiency and market risk hinder DeFi's further development. Uniswap V3, a leading and groundbreaking DEX project, addresses capital efficiency by enabling LPs to concentrate their liquidity within specific price ranges for deposited assets. Nevertheless, this approach exacerbates market risk, as LPs earn trading fees only when asset prices are within these predetermined brackets. To mitigate this issue, this paper introduces a deep reinforcement learning (DRL) solution designed to adaptively adjust these price ranges, maximizing profits and mitigating market risks. Our approach also neutralizes price-change risks by hedging the liquidity position through a rebalancing portfolio in a centralized futures exchange. The DRL policy aims to optimize trading fees earned by LPs against associated costs, such as gas fees and hedging expenses, which is referred to as loss-versus-rebalancing (LVR). Using simulations with a profit-and-loss (PnL) benchmark, our method demonstrates superior performance in ETH/USDC and ETH/USDT pools compared to existing baselines. We believe that this strategy not only offers investors a valuable asset management tool but also introduces a new incentive mechanism for DEX designers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStrategic Liquidity Provision in Uniswap v3

David C. Parkes, Zhou Fan, Michael Neuder et al.

Differential Liquidity Provision in Uniswap v3 and Implications for Contract Design

David C. Parkes, He Sun, Xintong Wang et al.

Uniswap Liquidity Provision: An Online Learning Approach

Yishay Mansour, Yogev Bar-On

| Title | Authors | Year | Actions |

|---|

Comments (0)