Summary

As the cornerstone of modern portfolio theory, Markowitz's mean-variance optimization is considered a major model adopted in portfolio management. However, due to the difficulty of estimating its parameters, it cannot be applied to all periods. In some cases, naive strategies such as Equally-weighted and Value-weighted portfolios can even get better performance. Under these circumstances, we can use multiple classic strategies as multiple strategic arms in multi-armed bandit to naturally establish a connection with the portfolio selection problem. This can also help to maximize the rewards in the bandit algorithm by the trade-off between exploration and exploitation. In this paper, we present a portfolio bandit strategy through Thompson sampling which aims to make online portfolio choices by effectively exploiting the performances among multiple arms. Also, by constructing multiple strategic arms, we can obtain the optimal investment portfolio to adapt different investment periods. Moreover, we devise a novel reward function based on users' different investment risk preferences, which can be adaptive to various investment styles. Our experimental results demonstrate that our proposed portfolio strategy has marked superiority across representative real-world market datasets in terms of extensive evaluation criteria.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

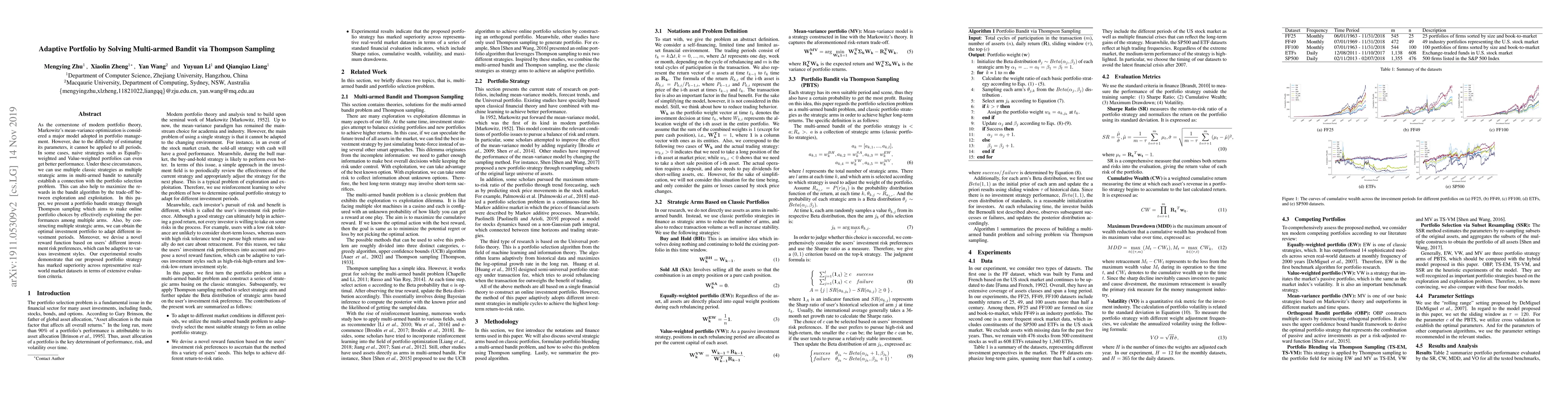

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)