Summary

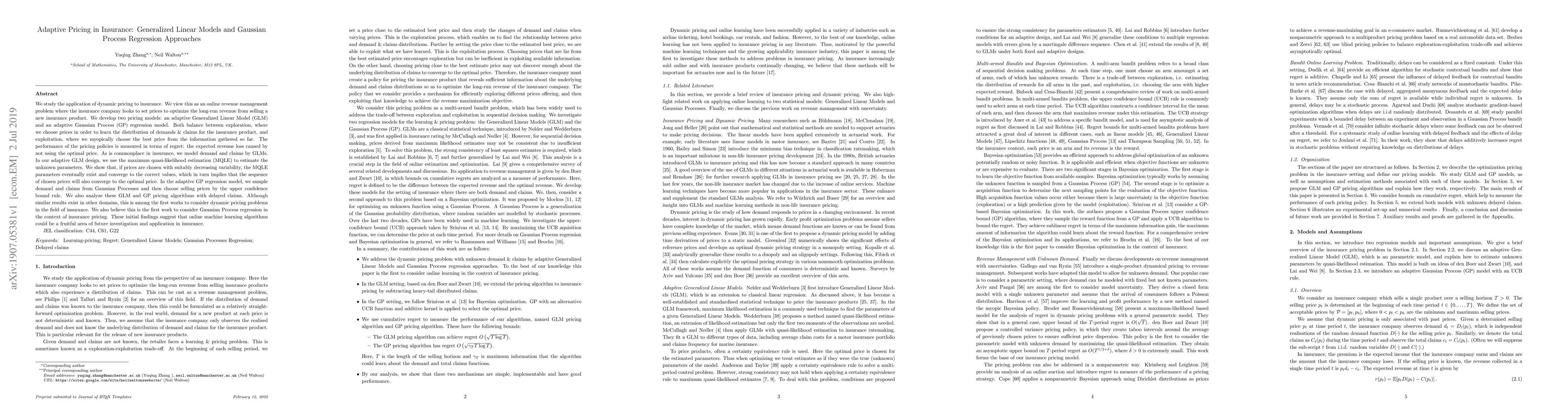

We study the application of dynamic pricing to insurance. We view this as an online revenue management problem where the insurance company looks to set prices to optimize the long-run revenue from selling a new insurance product. We develop two pricing models: an adaptive Generalized Linear Model (GLM) and an adaptive Gaussian Process (GP) regression model. Both balance between exploration, where we choose prices in order to learn the distribution of demands & claims for the insurance product, and exploitation, where we myopically choose the best price from the information gathered so far. The performance of the pricing policies is measured in terms of regret: the expected revenue loss caused by not using the optimal price. As is commonplace in insurance, we model demand and claims by GLMs. In our adaptive GLM design, we use the maximum quasi-likelihood estimation (MQLE) to estimate the unknown parameters. We show that, if prices are chosen with suitably decreasing variability, the MQLE parameters eventually exist and converge to the correct values, which in turn implies that the sequence of chosen prices will also converge to the optimal price. In the adaptive GP regression model, we sample demand and claims from Gaussian Processes and then choose selling prices by the upper confidence bound rule. We also analyze these GLM and GP pricing algorithms with delayed claims. Although similar results exist in other domains, this is among the first works to consider dynamic pricing problems in the field of insurance. We also believe this is the first work to consider Gaussian Process regression in the context of insurance pricing. These initial findings suggest that online machine learning algorithms could be a fruitful area of future investigation and application in insurance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAdaptive Optimizable Gaussian Process Regression Linear Least Squares Regression Filtering Method for SEM Images

K. S. Sim, D. Chee Yong Ong, I. Bukhori et al.

Adaptive Gaussian Process Regression for Bayesian inverse problems

Martin Weiser, Paolo Villani, Jörg Unger

| Title | Authors | Year | Actions |

|---|

Comments (0)