Authors

Summary

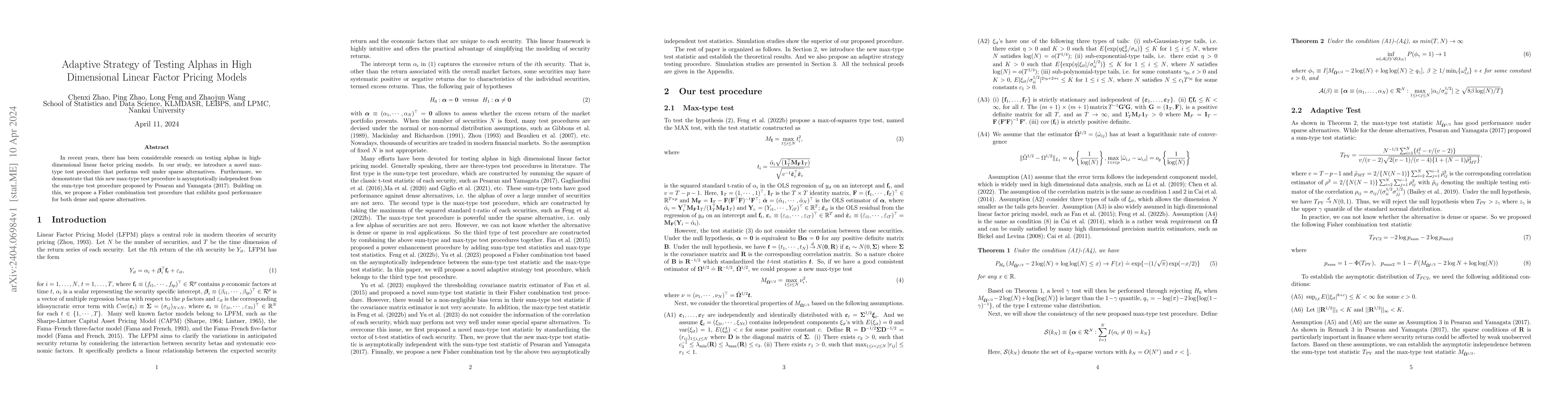

In recent years, there has been considerable research on testing alphas in high-dimensional linear factor pricing models. In our study, we introduce a novel max-type test procedure that performs well under sparse alternatives. Furthermore, we demonstrate that this new max-type test procedure is asymptotically independent from the sum-type test procedure proposed by Pesaran and Yamagata (2017). Building on this, we propose a Fisher combination test procedure that exhibits good performance for both dense and sparse alternatives.

AI Key Findings - Processing

Key findings are being generated. Please check back in a few minutes.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAdaptive Testing for Alphas in High-dimensional Factor Pricing Models

Xianyang Zhang, Qiang Xia

Adaptive Testing for Alphas in Conditional Factor Models with High Dimensional Assets

Long Feng, Zhaojun Wang, Huifang MA

Testing Alpha in High Dimensional Linear Factor Pricing Models with Dependent Observations

Long Feng, Jigang Bao, Zhaojun Wang et al.

Double Robust high dimensional alpha test for linear factor pricing model

Long Feng, Hongfei Wang, Ping Zhao et al.

No citations found for this paper.

Comments (0)