Authors

Summary

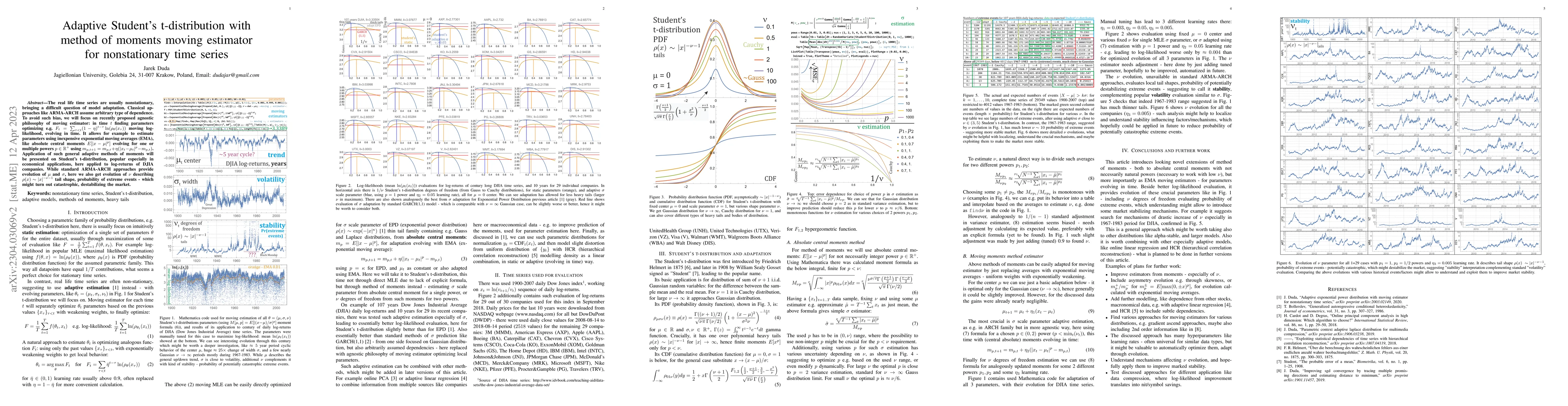

The real life time series are usually nonstationary, bringing a difficult

question of model adaptation. Classical approaches like ARMA-ARCH assume

arbitrary type of dependence. To avoid such bias, we will focus on recently

proposed agnostic philosophy of moving estimator: in time $t$ finding

parameters optimizing e.g. $F_t=\sum_{\tau

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)