Summary

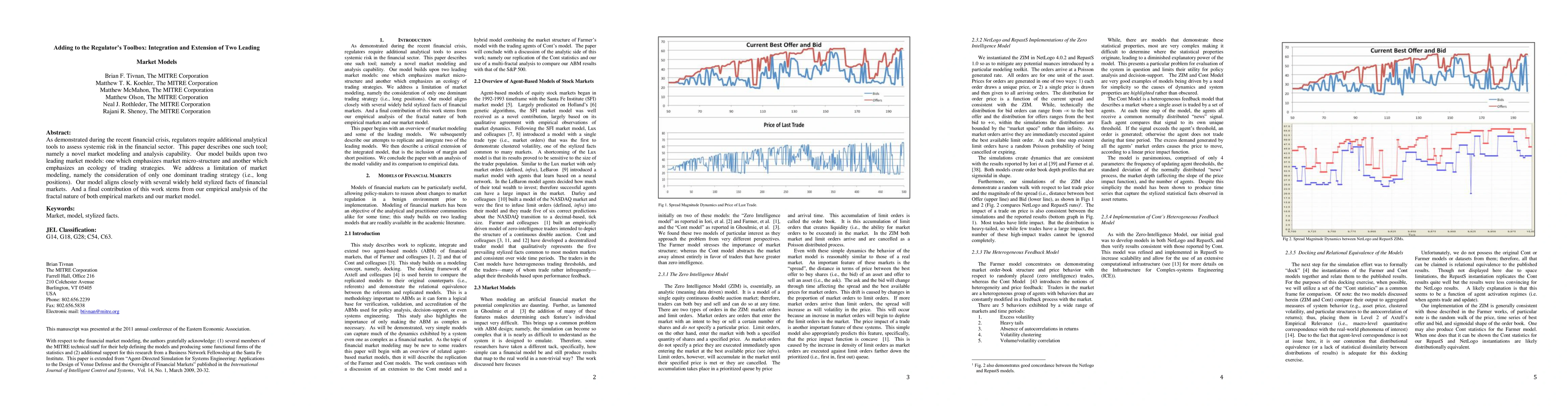

As demonstrated during the recent financial crisis, regulators require additional analytical tools to assess systemic risk in the financial sector. This paper describes one such tool; namely a novel market modeling and analysis capability. Our model builds upon two leading market models: one which emphasizes market micro-structure and another which emphasizes an ecology of trading strategies. We address a limitation of market modeling, namely the consideration of only one dominant trading strategy (i.e., long positions). Our model aligns closely with several widely held stylized facts of financial markets. And a final contribution of this work stems from our empirical analysis of the fractal nature of both empirical markets and our market model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultilayer Integration of Networks Toolbox (MINT).

Alzheimer’s Disease Neuroimaging Initiative, Sarraf, Saman, Avelar-Pereira, Bárbara et al.

Market-GAN: Adding Control to Financial Market Data Generation with Semantic Context

Shuo Sun, Haochong Xia, Xinrun Wang et al.

Market Integration of Excess Heat

Jalal Kazempour, Linde Frölke, Ida-Marie Palm

| Title | Authors | Year | Actions |

|---|

Comments (0)