Summary

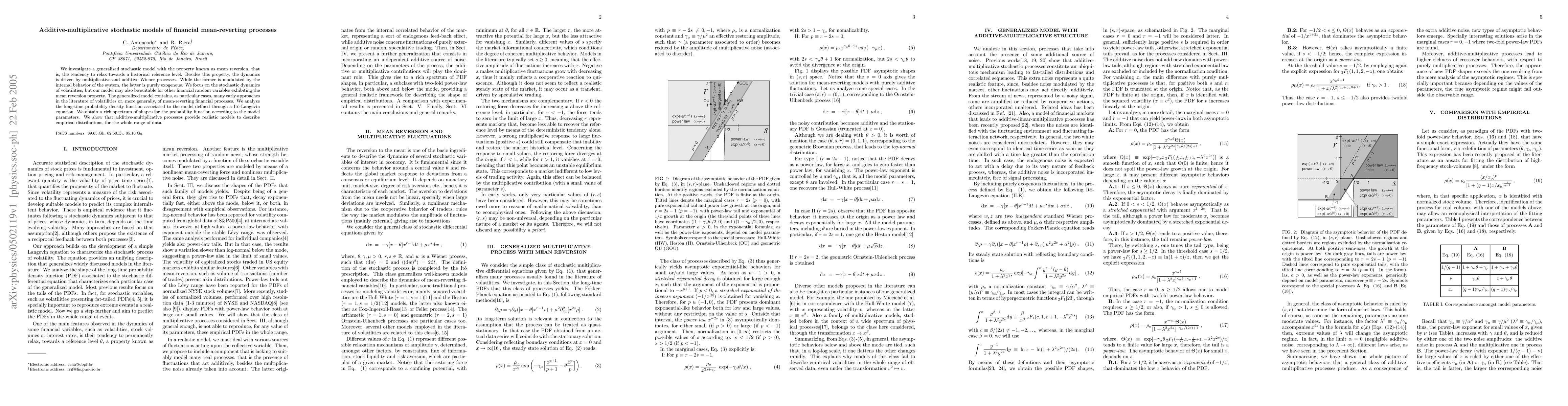

We investigate a generalized stochastic model with the property known as mean reversion, that is, the tendency to relax towards a historical reference level. Besides this property, the dynamics is driven by multiplicative and additive Wiener processes. While the former is modulated by the internal behavior of the system, the latter is purely exogenous. We focus on the stochastic dynamics of volatilities, but our model may also be suitable for other financial random variables exhibiting the mean reversion property. The generalized model contains, as particular cases, many early approaches in the literature of volatilities or, more generally, of mean-reverting financial processes. We analyze the long-time probability density function associated to the model defined through a It\^o-Langevin equation. We obtain a rich spectrum of shapes for the probability function according to the model parameters. We show that additive-multiplicative processes provide realistic models to describe empirical distributions, for the whole range of data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)