Authors

Summary

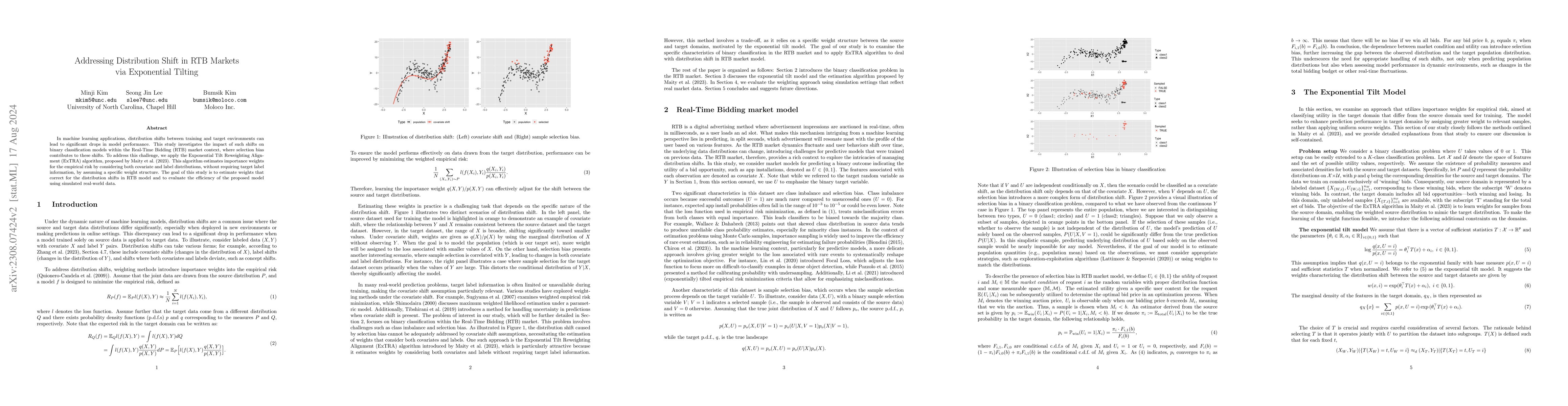

Distribution shift in machine learning models can be a primary cause of performance degradation. This paper delves into the characteristics of these shifts, primarily motivated by Real-Time Bidding (RTB) market models. We emphasize the challenges posed by class imbalance and sample selection bias, both potent instigators of distribution shifts. This paper introduces the Exponential Tilt Reweighting Alignment (ExTRA) algorithm, as proposed by Marty et al. (2023), to address distribution shifts in data. The ExTRA method is designed to determine the importance weights on the source data, aiming to minimize the KL divergence between the weighted source and target datasets. A notable advantage of this method is its ability to operate using labeled source data and unlabeled target data. Through simulated real-world data, we investigate the nature of distribution shift and evaluate the applicacy of the proposed model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAddressing Distribution Shift at Test Time in Pre-trained Language Models

Ayush Singh, John E. Ortega

Efficient k-means with Individual Fairness via Exponential Tilting

Sheng Wang, Shengkun Zhu, Jinshan Zeng et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)