Summary

Two of the most important areas in computational finance: Greeks and, respectively, calibration, are based on efficient and accurate computation of a large number of sensitivities. This paper gives an overview of adjoint and automatic differentiation (AD), also known as algorithmic differentiation, techniques to calculate these sensitivities. When compared to finite difference approximation, this approach can potentially reduce the computational cost by several orders of magnitude, with sensitivities accurate up to machine precision. Examples and a literature survey are also provided.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

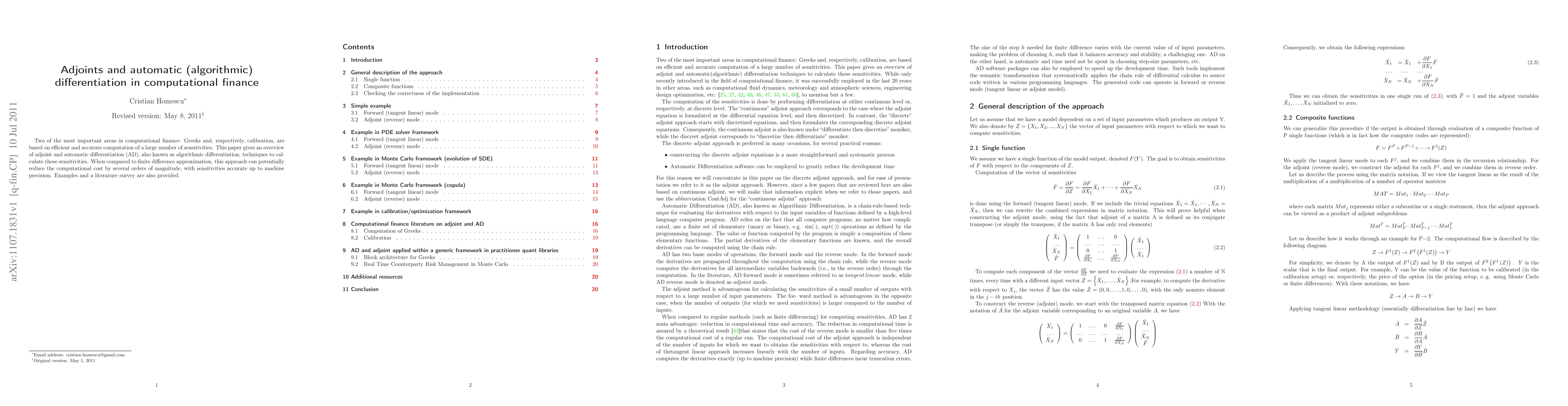

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAutomating Steady and Unsteady Adjoints: Efficiently Utilizing Implicit and Algorithmic Differentiation

Andrew Ning, Taylor McDonnell

Combinatory Adjoints and Differentiation

Robert Schenck, Robin Kaarsgaard, Fritz Henglein et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)