Authors

Summary

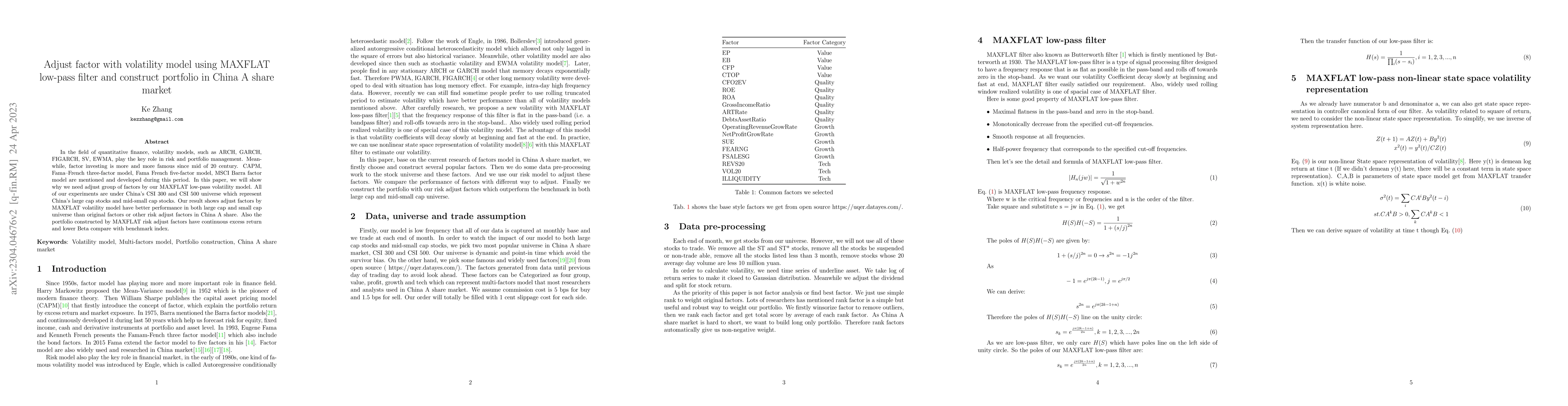

In the field of quantitative finance, volatility models, such as ARCH, GARCH, FIGARCH, SV, EWMA, play the key role in risk and portfolio management. Meanwhile, factor investing is more and more famous since mid of 20 century. CAPM, Fama French three factor model, Fama French five-factor model, MSCI Barra factor model are mentioned and developed during this period. In this paper, we will show why we need adjust group of factors by our MAXFLAT low-pass volatility model. All of our experiments are under China's CSI 300 and CSI 500 universe which represent China's large cap stocks and mid-small cap stocks. Our result shows adjust factors by MAXFLAT volatility model have better performance in both large cap and small cap universe than original factors or other risk adjust factors in China A share. Also the portfolio constructed by MAXFLAT risk adjust factors have continuous excess return and lower beta compare with benchmark index.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPortfolio Optimization with Allocation Constraints and Stochastic Factor Market Dynamics

Marcos Escobar-Anel, Michel Kschonnek, Rudi Zagst

| Title | Authors | Year | Actions |

|---|

Comments (0)