Authors

Summary

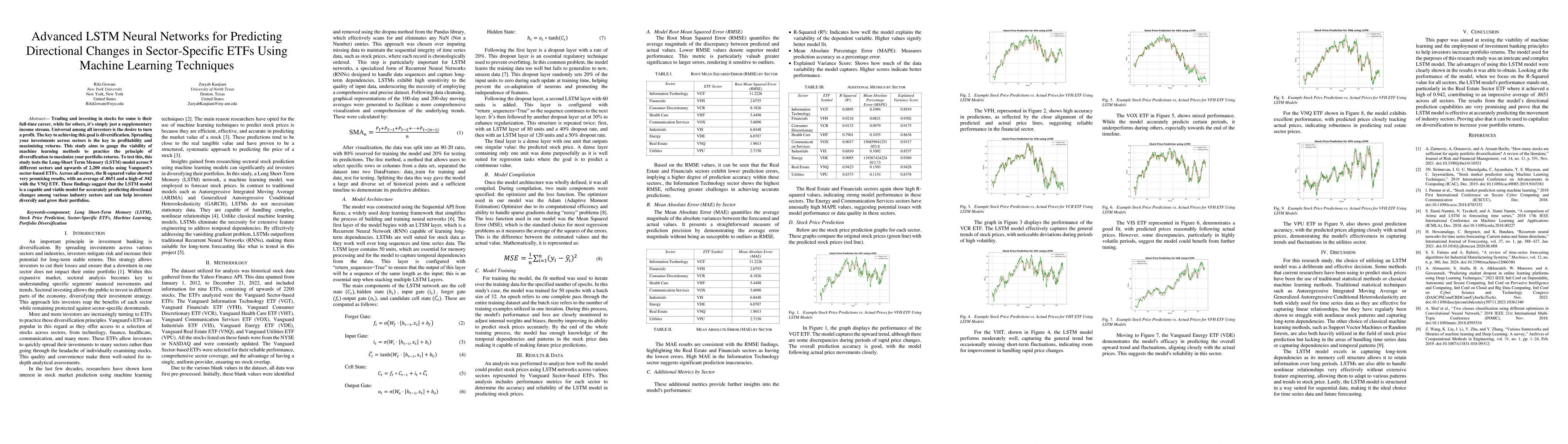

Trading and investing in stocks for some is their full-time career, while for others, it's simply a supplementary income stream. Universal among all investors is the desire to turn a profit. The key to achieving this goal is diversification. Spreading investments across sectors is critical to profitability and maximizing returns. This study aims to gauge the viability of machine learning methods in practicing the principle of diversification to maximize portfolio returns. To test this, the study evaluates the Long-Short Term Memory (LSTM) model across nine different sectors and over 2,200 stocks using Vanguard's sector-based ETFs. The R-squared value across all sectors showed promising results, with an average of 0.8651 and a high of 0.942 for the VNQ ETF. These findings suggest that the LSTM model is a capable and viable model for accurately predicting directional changes across various industry sectors, helping investors diversify and grow their portfolios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPredicting CO2 adsorption in KOH-activated biochar using advanced machine learning techniques.

Hassan, Raouf, Baghban, Alireza

Predicting Chaotic System Behavior using Machine Learning Techniques

Huaiyuan Rao, Yichen Zhao, Qiang Lai

No citations found for this paper.

Comments (0)