Summary

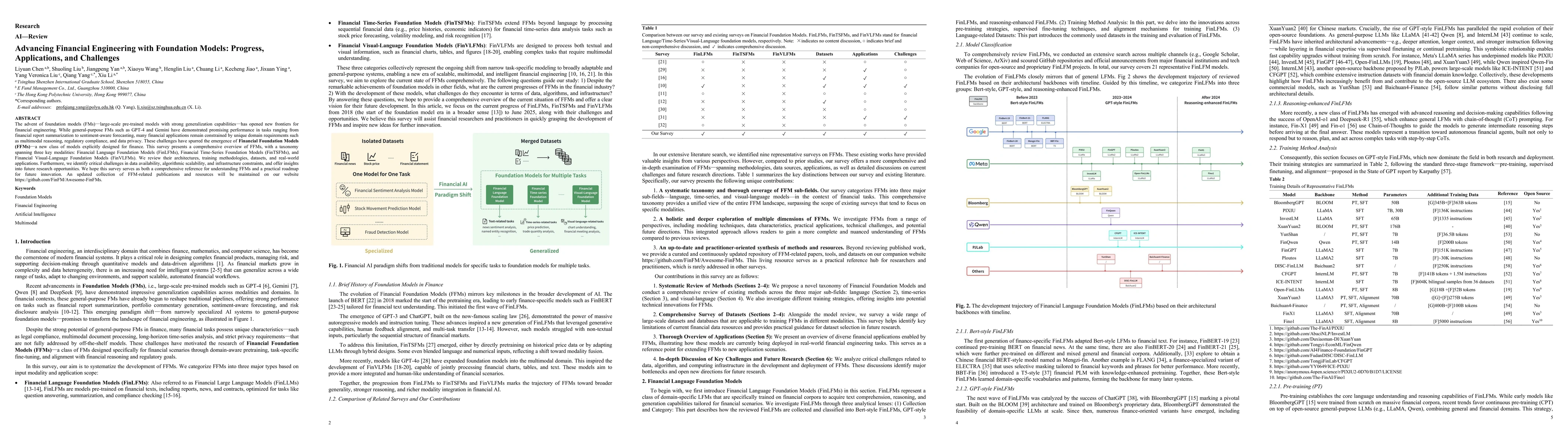

The advent of foundation models (FMs) - large-scale pre-trained models with strong generalization capabilities - has opened new frontiers for financial engineering. While general-purpose FMs such as GPT-4 and Gemini have demonstrated promising performance in tasks ranging from financial report summarization to sentiment-aware forecasting, many financial applications remain constrained by unique domain requirements such as multimodal reasoning, regulatory compliance, and data privacy. These challenges have spurred the emergence of Financial Foundation Models (FFMs) - a new class of models explicitly designed for finance. This survey presents a comprehensive overview of FFMs, with a taxonomy spanning three key modalities: Financial Language Foundation Models (FinLFMs), Financial Time-Series Foundation Models (FinTSFMs), and Financial Visual-Language Foundation Models (FinVLFMs). We review their architectures, training methodologies, datasets, and real-world applications. Furthermore, we identify critical challenges in data availability, algorithmic scalability, and infrastructure constraints, and offer insights into future research opportunities. We hope this survey serves as both a comprehensive reference for understanding FFMs and a practical roadmap for future innovation. An updated collection of FFM-related publications and resources will be maintained on our website https://github.com/FinFM/Awesome-FinFMs.

AI Key Findings

Generated Sep 02, 2025

Methodology

The paper provides a comprehensive survey of Financial Foundation Models (FFMs), categorizing them into Financial Language Foundation Models (FinLFMs), Financial Time-Series Foundation Models (FinTSFMs), and Financial Visual-Language Foundation Models (FinVLFMs). It reviews their architectures, training methodologies, datasets, and applications, while also identifying challenges and future research opportunities.

Key Results

- FFMs have shown promising performance in financial tasks, with FinLFMs maturing rapidly and FinTSFMs still in early stages.

- Two main categories of FinTSFMs have emerged: models trained from scratch on time-series data and those adapted from pre-trained language foundation models.

- FinVLFMs, which process financial visual information alongside text, are in early developmental stages with only a few representative works.

- The paper highlights the need for larger, more diverse, and practically grounded benchmarks to support FinTSFMs advancement.

- FFM-based applications are reviewed, showcasing the use of both general-purpose and domain-specific FFMs in financial data structuring, market prediction, trading, and multi-agent systems.

Significance

This survey serves as a comprehensive reference for understanding FFMs and a practical roadmap for future innovation in financial engineering, addressing the unique requirements of the finance domain and identifying key challenges and opportunities for researchers and practitioners.

Technical Contribution

The paper presents a taxonomy and review of Financial Foundation Models, categorizing them into FinLFMs, FinTSFMs, and FinVLFMs, and discussing their architectures, training methodologies, datasets, and applications.

Novelty

The work differentiates itself by providing a structured overview of FFMs tailored for the finance domain, identifying specific challenges, and outlining future research directions in this emerging field.

Limitations

- The paper notes that FinTSFMs lack multimodal capabilities, constraining their versatility in real-world financial scenarios.

- Data availability, algorithmic scalability, and infrastructure constraints pose significant challenges for FFM development and deployment.

Future Work

- Future research should focus on building larger, more diverse, and practically grounded financial time-series datasets.

- Advances in model design and data ecosystem are critical to unlocking the full potential of FinTSFMs in complex real-world financial applications.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultimodal Financial Foundation Models (MFFMs): Progress, Prospects, and Challenges

Yupeng Cao, Xiao-Yang Liu Yanglet, Li Deng

A Survey of Large Language Models for Financial Applications: Progress, Prospects and Challenges

Stefan Zohren, Qingsong Wen, H. Vincent Poor et al.

Foundation Model for Advancing Healthcare: Challenges, Opportunities, and Future Directions

Hao Chen, Fuxiang Huang, Xinrui Jiang et al.

Foundation Model Engineering: Engineering Foundation Models Just as Engineering Software

Wei Yang, Tao Xie, Dezhi Ran et al.

No citations found for this paper.

Comments (0)