Summary

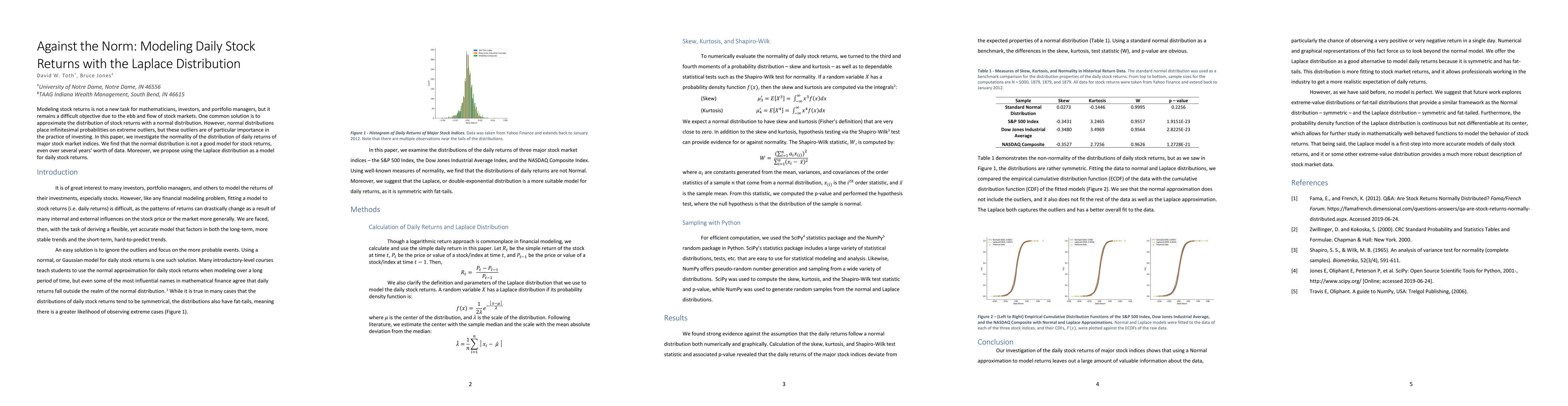

Modeling stock returns is not a new task for mathematicians, investors, and portfolio managers, but it remains a difficult objective due to the ebb and flow of stock markets. One common solution is to approximate the distribution of stock returns with a normal distribution. However, normal distributions place infinitesimal probabilities on extreme outliers, but these outliers are of particular importance in the practice of investing. In this paper, we investigate the normality of the distribution of daily returns of major stock market indices. We find that the normal distribution is not a good model for stock returns, even over several years' worth of data. Moreover, we propose using the Laplace distribution as a model for daily stock returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)