Summary

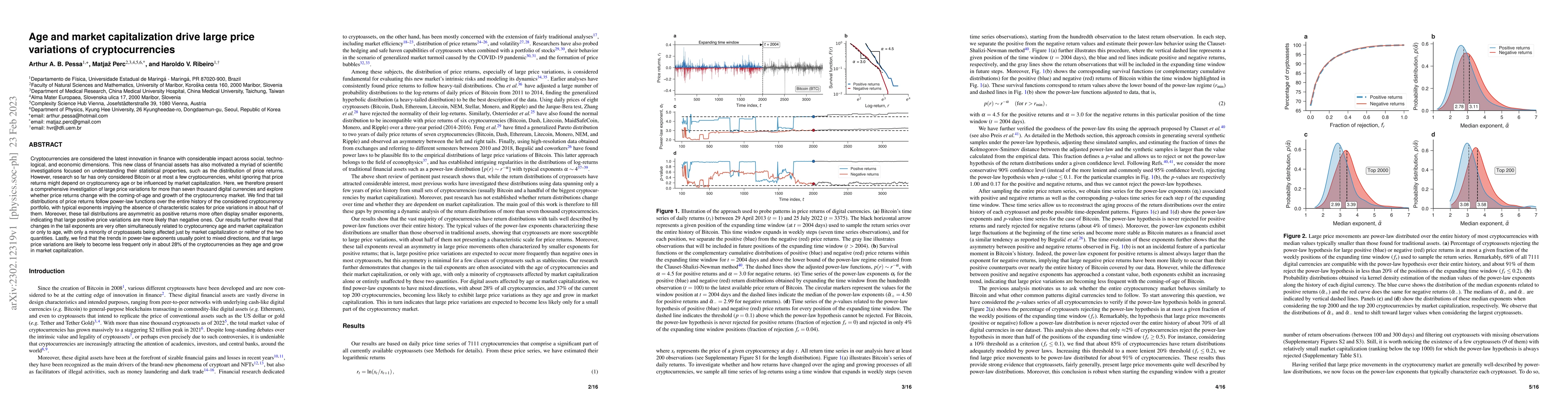

Cryptocurrencies are considered the latest innovation in finance with considerable impact across social, technological, and economic dimensions. This new class of financial assets has also motivated a myriad of scientific investigations focused on understanding their statistical properties, such as the distribution of price returns. However, research so far has only considered Bitcoin or at most a few cryptocurrencies, whilst ignoring that price returns might depend on cryptocurrency age or be influenced by market capitalization. Here, we therefore present a comprehensive investigation of large price variations for more than seven thousand digital currencies and explore whether price returns change with the coming-of-age and growth of the cryptocurrency market. We find that tail distributions of price returns follow power-law functions over the entire history of the considered cryptocurrency portfolio, with typical exponents implying the absence of characteristic scales for price variations in about half of them. Moreover, these tail distributions are asymmetric as positive returns more often display smaller exponents, indicating that large positive price variations are more likely than negative ones. Our results further reveal that changes in the tail exponents are very often simultaneously related to cryptocurrency age and market capitalization or only to age, with only a minority of cryptoassets being affected just by market capitalization or neither of the two quantities. Lastly, we find that the trends in power-law exponents usually point to mixed directions, and that large price variations are likely to become less frequent only in about 28\% of the cryptocurrencies as they age and grow in market capitalization.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAI-Assisted Investigation of On-Chain Parameters: Risky Cryptocurrencies and Price Factors

Abdulrezzak Zekiye, Oznur Ozkasap, Semih Utku et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)