Summary

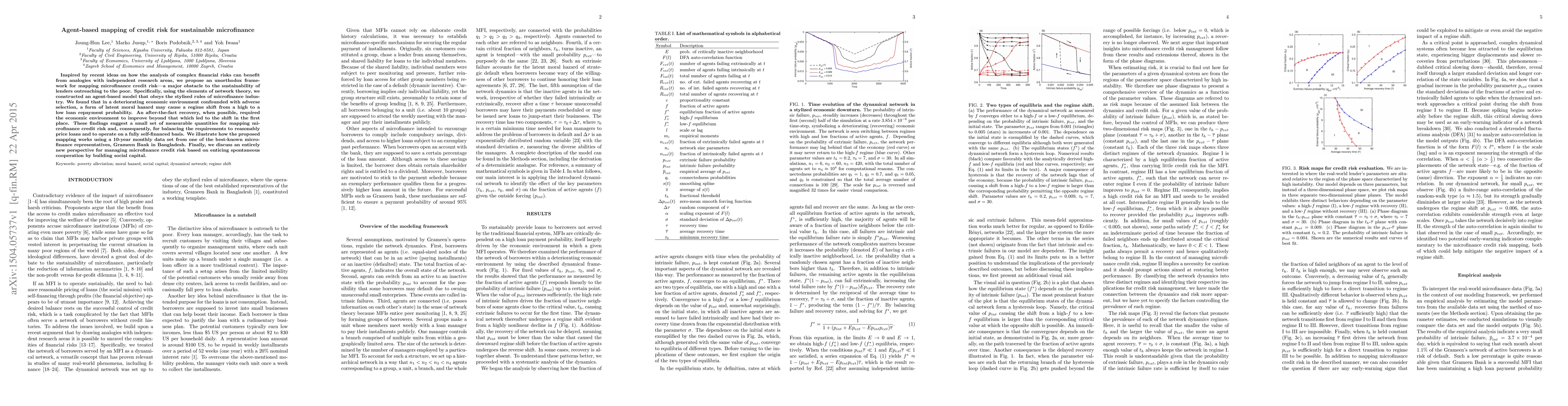

Inspired by recent ideas on how the analysis of complex financial risks can benefit from analogies with independent research areas, we propose an unorthodox framework for mapping microfinance credit risk---a major obstacle to the sustainability of lenders outreaching to the poor. Specifically, using the elements of network theory, we constructed an agent-based model that obeys the stylised rules of microfinance industry. We found that in a deteriorating economic environment confounded with adverse selection, a form of latent moral hazard may cause a regime shift from a high to a low loan repayment probability. An after-the-fact recovery, when possible, required the economic environment to improve beyond that which led to the shift in the first place. These findings suggest a small set of measurable quantities for mapping microfinance credit risk and, consequently, for balancing the requirements to reasonably price loans and to operate on a fully self-financed basis. We illustrate how the proposed mapping works using a 10-year monthly data set from one of the best-known microfinance representatives, Grameen Bank in Bangladesh. Finally, we discuss an entirely new perspective for managing microfinance credit risk based on enticing spontaneous cooperation by building social capital.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Learning and Control Perspective for Microfinance

Yorie Nakahira, Xiyu Deng, Christian Kurniawan et al.

Agent-based Modelling of Credit Card Promotions

Salvatore Mercuri, Conor B. Hamill, Raad Khraishi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)