Summary

An agent-based model for firms' dynamics is developed. The model consists of firm agents with identical characteristic parameters and a bank agent. Dynamics of those agents is described by their balance sheets. Each firm tries to maximize its expected profit with possible risks in market. Infinite growth of a firm directed by the "profit maximization" principle is suppressed by a concept of "going concern". Possibility of bankruptcy of firms is also introduced by incorporating a retardation effect of information on firms' decision. The firms, mutually interacting through the monopolistic bank, become heterogeneous in the course of temporal evolution. Statistical properties of firms' dynamics obtained by simulations based on the model are discussed in light of observations in the real economy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

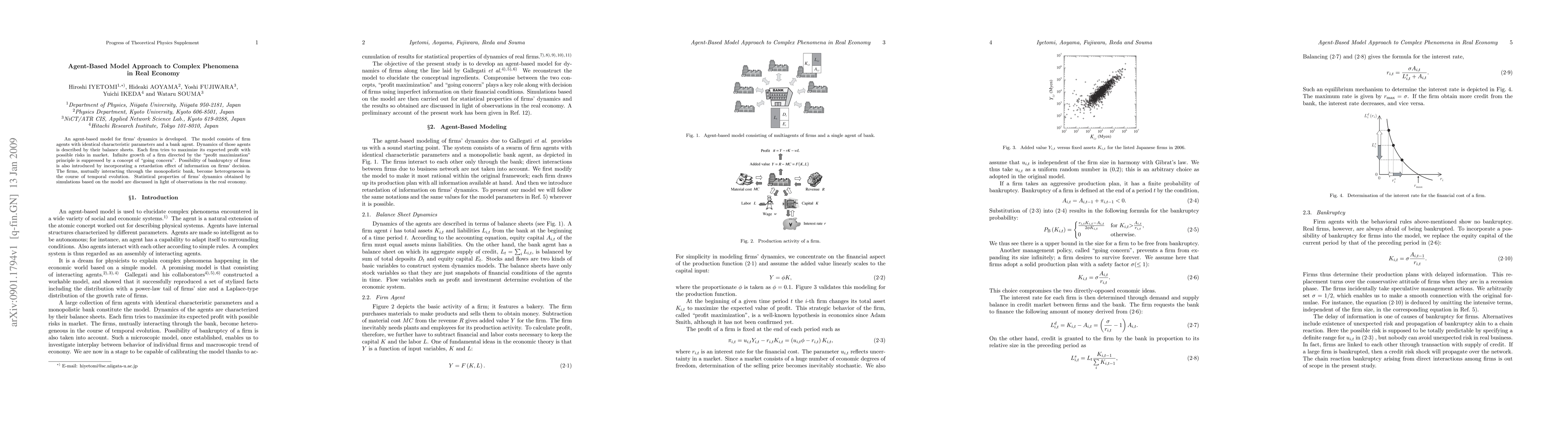

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)