Summary

The advent of large language models has ushered in a new era of agentic systems, where artificial intelligence programs exhibit remarkable autonomous decision-making capabilities across diverse domains. This paper explores agentic system workflows in the financial services industry. In particular, we build agentic crews that can effectively collaborate to perform complex modeling and model risk management (MRM) tasks. The modeling crew consists of a manager and multiple agents who perform specific tasks such as exploratory data analysis, feature engineering, model selection, hyperparameter tuning, model training, model evaluation, and writing documentation. The MRM crew consists of a manager along with specialized agents who perform tasks such as checking compliance of modeling documentation, model replication, conceptual soundness, analysis of outcomes, and writing documentation. We demonstrate the effectiveness and robustness of modeling and MRM crews by presenting a series of numerical examples applied to credit card fraud detection, credit card approval, and portfolio credit risk modeling datasets.

AI Key Findings

Generated Jun 11, 2025

Methodology

This paper explores the application of agentic AI systems in financial services, specifically for modeling and model risk management (MRM) tasks. It introduces crews consisting of a manager and multiple agents, each with specialized roles such as data extraction, exploratory data analysis, feature engineering, model selection, hyperparameter tuning, model training, model evaluation, and documentation.

Key Results

- Agentic crews effectively collaborate to perform complex modeling and MRM tasks.

- The modeling crew demonstrates robust performance in credit card fraud detection, credit card approval, and portfolio credit risk modeling datasets.

- The MRM crew ensures compliance, model replication, conceptual soundness, and outcome analysis.

Significance

The research is significant as it showcases the potential of agentic AI systems in the financial services industry, improving efficiency, accuracy, and compliance in modeling tasks.

Technical Contribution

The paper presents a novel framework for organizing AI agents into crews to handle various aspects of modeling and MRM tasks in financial services, enhancing collaboration and efficiency.

Novelty

This work is novel in its application of agentic AI systems to financial services, specifically for modeling and MRM tasks, and its introduction of specialized agent roles within crews to handle diverse responsibilities.

Limitations

- The study does not extensively cover the ethical implications of agentic AI systems.

- The paper focuses primarily on three datasets, which might limit the generalizability of findings to other financial domains.

Future Work

- Investigate the ethical considerations and potential biases in agentic AI systems for financial services.

- Explore the applicability of these agentic systems in other financial domains beyond the three datasets used in this research.

Paper Details

PDF Preview

Citation Network

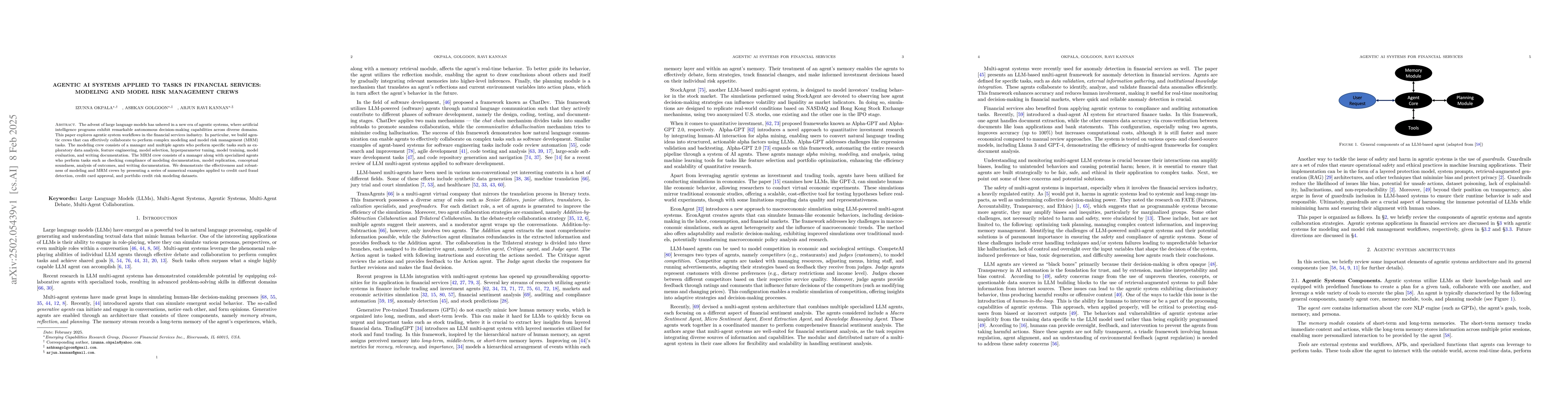

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModel Risk Management for Generative AI In Financial Institutions

Anwesha Bhattacharyya, Rahul Singh, Tarun Joshi et al.

TRiSM for Agentic AI: A Review of Trust, Risk, and Security Management in LLM-based Agentic Multi-Agent Systems

Shaina Raza, Ranjan Sapkota, Manoj Karkee et al.

Risk Alignment in Agentic AI Systems

Hayley Clatterbuck, Clinton Castro, Arvo Muñoz Morán

| Title | Authors | Year | Actions |

|---|

Comments (0)