Summary

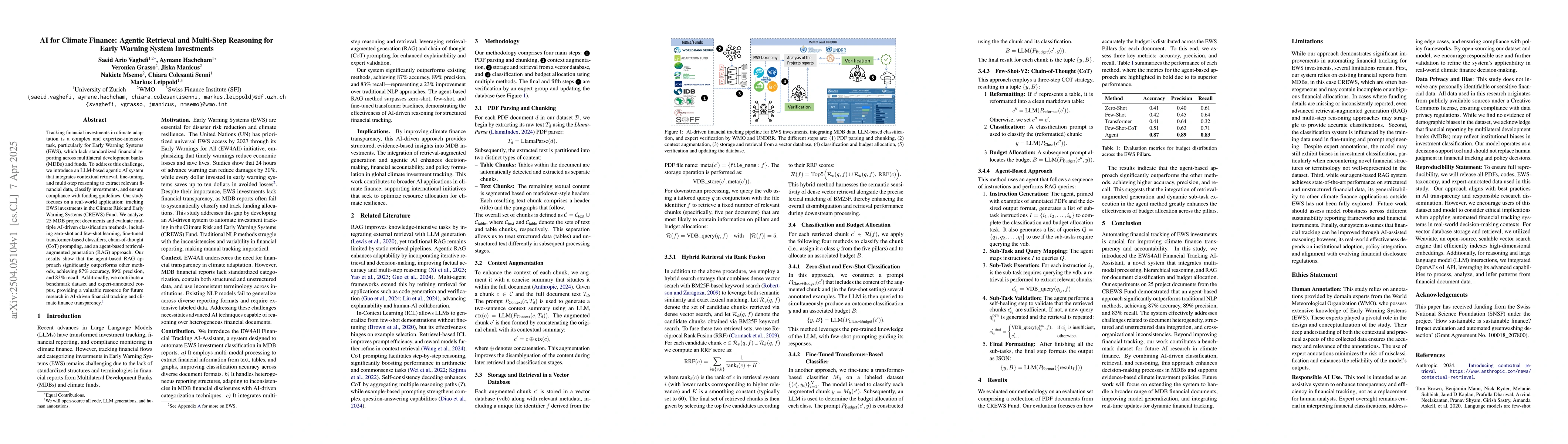

Tracking financial investments in climate adaptation is a complex and expertise-intensive task, particularly for Early Warning Systems (EWS), which lack standardized financial reporting across multilateral development banks (MDBs) and funds. To address this challenge, we introduce an LLM-based agentic AI system that integrates contextual retrieval, fine-tuning, and multi-step reasoning to extract relevant financial data, classify investments, and ensure compliance with funding guidelines. Our study focuses on a real-world application: tracking EWS investments in the Climate Risk and Early Warning Systems (CREWS) Fund. We analyze 25 MDB project documents and evaluate multiple AI-driven classification methods, including zero-shot and few-shot learning, fine-tuned transformer-based classifiers, chain-of-thought (CoT) prompting, and an agent-based retrieval-augmented generation (RAG) approach. Our results show that the agent-based RAG approach significantly outperforms other methods, achieving 87\% accuracy, 89\% precision, and 83\% recall. Additionally, we contribute a benchmark dataset and expert-annotated corpus, providing a valuable resource for future research in AI-driven financial tracking and climate finance transparency.

AI Key Findings

Generated Jun 10, 2025

Methodology

The study introduces an LLM-based agentic AI system for extracting relevant financial data, classifying investments, and ensuring compliance with funding guidelines for Early Warning Systems (EWS) in climate adaptation finance. The approach integrates contextual retrieval, fine-tuning, and multi-step reasoning, including zero-shot and few-shot learning, fine-tuned transformer-based classifiers, chain-of-thought (CoT) prompting, and an agent-based retrieval-augmented generation (RAG) approach.

Key Results

- The agent-based RAG approach significantly outperforms other methods, achieving 87% accuracy, 89% precision, and 83% recall in classifying EWS investments.

- The study contributes a benchmark dataset and expert-annotated corpus for future research in AI-driven financial tracking and climate finance transparency.

Significance

This research is crucial for improving climate finance transparency and accountability by automating the tracking of financial investments in climate adaptation, particularly for EWS which lack standardized financial reporting across multilateral development banks (MDBs) and funds.

Technical Contribution

The paper presents an innovative AI-driven approach for classifying and budget-allocating financial documents related to climate adaptation, using an agent-based RAG system that significantly outperforms traditional NLP methods.

Novelty

This work stands out by combining AI-driven classification, retrieval, and reasoning to enhance decision-making processes in MDBs and support evidence-based climate investment policies, contributing a benchmark dataset for future AI research in climate finance.

Limitations

- The system relies on existing financial reports from MDBs, which can be heterogeneous and may contain incomplete or ambiguous financial allocations.

- The classification system is influenced by the training data used for fine-tuning and prompt engineering, potentially exhibiting biases in investment classification, especially for novel financial structures or terminology not well-represented in the dataset.

Future Work

- Extend the system to handle a broader range of MDB financial documents and improve model generalization.

- Integrate real-time updates for dynamic financial tracking.

- Assess the model's robustness across different sustainability reporting frameworks and financial instruments.

- Explore the real-world effectiveness of the AI-assisted reasoning approach, depending on institutional adoption, policy integration, and alignment with evolving financial disclosure regulations.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersReasoning RAG via System 1 or System 2: A Survey on Reasoning Agentic Retrieval-Augmented Generation for Industry Challenges

Rui Zhao, Ziyue Li, Gang Su et al.

Toward Agentic AI: Generative Information Retrieval Inspired Intelligent Communications and Networking

Dusit Niyato, Shiwen Mao, Zhu Han et al.

STEPER: Step-wise Knowledge Distillation for Enhancing Reasoning Ability in Multi-Step Retrieval-Augmented Language Models

Hwanjo Yu, Sanghwan Jang, Kyumin Lee et al.

No citations found for this paper.

Comments (0)