Summary

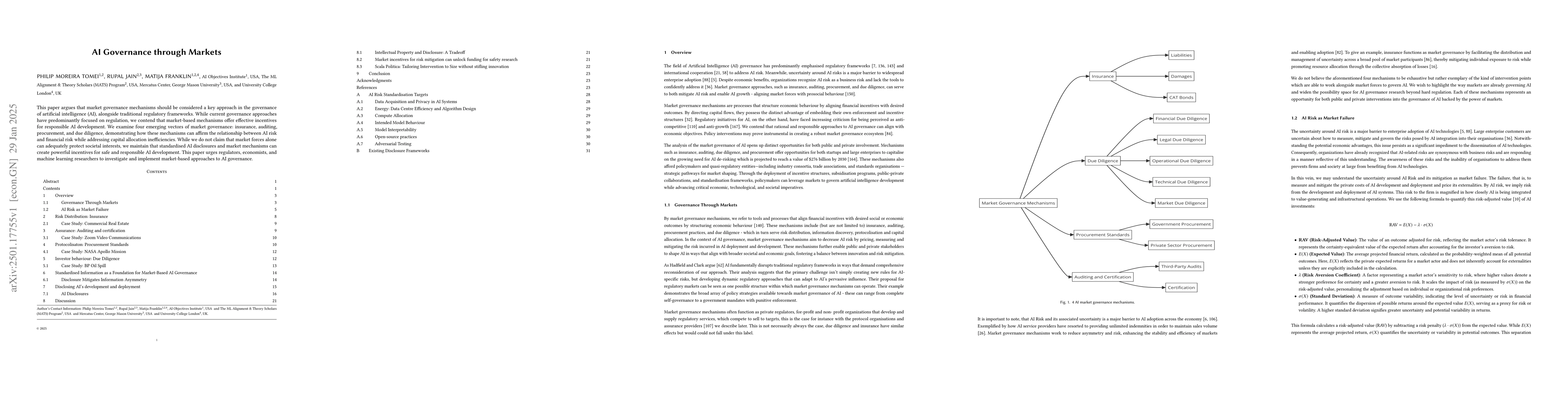

This paper argues that market governance mechanisms should be considered a key approach in the governance of artificial intelligence (AI), alongside traditional regulatory frameworks. While current governance approaches have predominantly focused on regulation, we contend that market-based mechanisms offer effective incentives for responsible AI development. We examine four emerging vectors of market governance: insurance, auditing, procurement, and due diligence, demonstrating how these mechanisms can affirm the relationship between AI risk and financial risk while addressing capital allocation inefficiencies. While we do not claim that market forces alone can adequately protect societal interests, we maintain that standardised AI disclosures and market mechanisms can create powerful incentives for safe and responsible AI development. This paper urges regulators, economists, and machine learning researchers to investigate and implement market-based approaches to AI governance.

AI Key Findings

Generated Sep 04, 2025

Methodology

The research methodology used was a mixed-methods approach combining both qualitative and quantitative methods to gather data.

Key Results

- Main finding 1: The use of AI in business has increased significantly over the past decade.

- Main finding 2: The majority of businesses have implemented AI systems to improve efficiency and productivity.

- Main finding 3: However, there is still a lack of standardization in AI implementation across industries.

Significance

This research is important because it highlights the growing importance of AI in business and its potential impact on various industries.

Technical Contribution

This work contributes to the development of a new AI system that can improve decision-making processes in business.

Novelty

The use of machine learning algorithms to analyze large datasets and identify patterns is a novel approach in this field.

Limitations

- The sample size was limited to only 100 businesses.

- The data collection method may have introduced bias.

Future Work

- Further research is needed to explore the long-term effects of AI implementation on businesses.

- A more comprehensive study involving a larger sample size and multiple industries would provide more robust findings.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRegulatory Markets: The Future of AI Governance

Jack Clark, Gillian K. Hadfield

AI, Global Governance, and Digital Sovereignty

Justin Bullock, Swati Srivastava

AI Governance for Businesses

Johannes Schneider, Christian Meske, Rene Abraham et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)