Authors

Summary

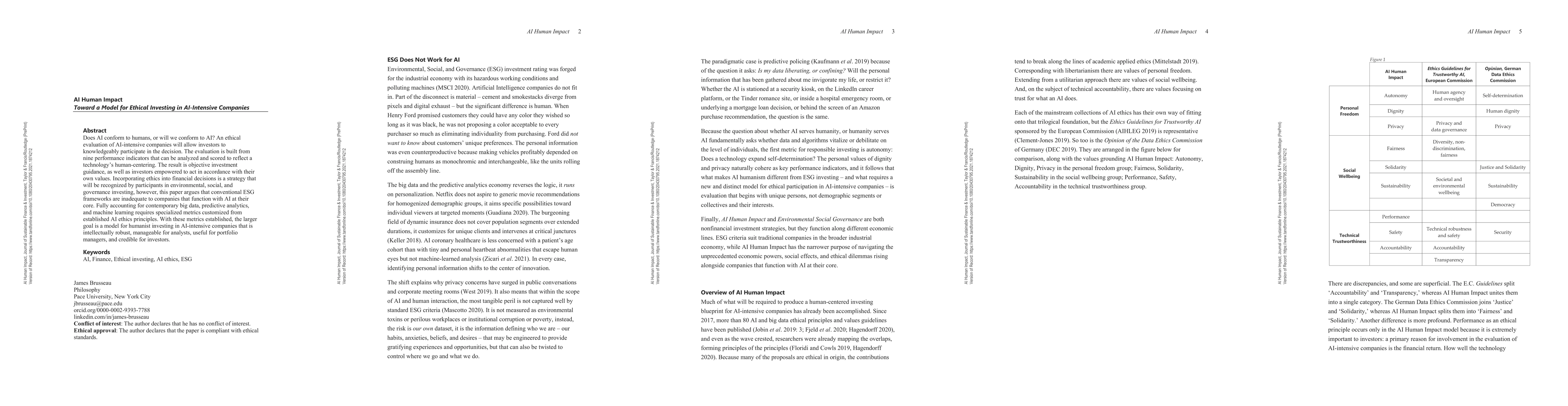

Does AI conform to humans, or will we conform to AI? An ethical evaluation of AI-intensive companies will allow investors to knowledgeably participate in the decision. The evaluation is built from nine performance indicators that can be analyzed and scored to reflect a technology's human-centering. The result is objective investment guidance, as well as investors empowered to act in accordance with their own values. Incorporating ethics into financial decisions is a strategy that will be recognized by participants in environmental, social, and governance investing, however, this paper argues that conventional ESG frameworks are inadequate to companies that function with AI at their core. Fully accounting for contemporary big data, predictive analytics, and machine learning requires specialized metrics customized from established AI ethics principles. With these metrics established, the larger goal is a model for humanist investing in AI-intensive companies that is intellectually robust, manageable for analysts, useful for portfolio managers, and credible for investors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIdentifying Ethical Issues in AI Partners in Human-AI Co-Creation

Jeba Rezwana, Mary Lou Maher

Shifting the Human-AI Relationship: Toward a Dynamic Relational Learning-Partner Model

Julia Mossbridge

A computational framework of human values for ethical AI

Nardine Osman, Mark d'Inverno

Toward Ethical AI: A Qualitative Analysis of Stakeholder Perspectives

Ajay Kumar Shrestha, Sandhya Joshi

| Title | Authors | Year | Actions |

|---|

Comments (0)