Summary

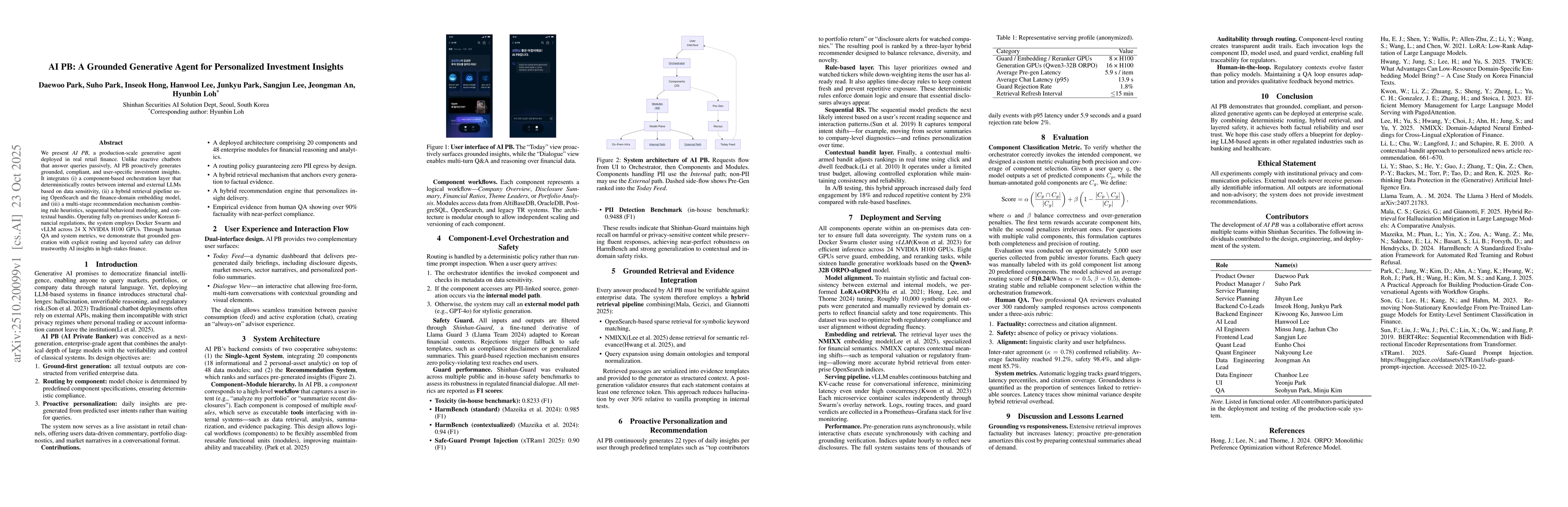

We present AI PB, a production-scale generative agent deployed in real retail finance. Unlike reactive chatbots that answer queries passively, AI PB proactively generates grounded, compliant, and user-specific investment insights. It integrates (i) a component-based orchestration layer that deterministically routes between internal and external LLMs based on data sensitivity, (ii) a hybrid retrieval pipeline using OpenSearch and the finance-domain embedding model, and (iii) a multi-stage recommendation mechanism combining rule heuristics, sequential behavioral modeling, and contextual bandits. Operating fully on-premises under Korean financial regulations, the system employs Docker Swarm and vLLM across 24 X NVIDIA H100 GPUs. Through human QA and system metrics, we demonstrate that grounded generation with explicit routing and layered safety can deliver trustworthy AI insights in high-stakes finance.

AI Key Findings

Generated Oct 25, 2025

Methodology

The research presents AI PB, a generative agent deployed in real retail finance, combining component-based orchestration, hybrid retrieval pipelines, and multi-stage recommendation mechanisms. It operates on-premises under Korean financial regulations using Docker Swarm and vLLM across 24 NVIDIA H100 GPUs.

Key Results

- AI PB achieves over 90% factuality with near-perfect compliance through grounded generation and safety routing.

- The hybrid retrieval mechanism anchors every generation to factual evidence, reducing hallucination by over 30%.

- The hybrid recommendation engine increases daily feed engagement by 18% and reduces repetitive content by 23%.

Significance

This research is significant as it demonstrates the deployment of a trustworthy AI system in high-stakes finance, offering personalized insights while complying with strict regulations. It provides a blueprint for deploying LLM-based agents in other regulated industries.

Technical Contribution

The paper contributes a deployed architecture with 20 components and 48 enterprise modules for financial reasoning, a routing policy ensuring zero PII egress, and a hybrid recommendation engine combining rule heuristics, sequential modeling, and contextual bandits.

Novelty

The novelty lies in the combination of deterministic routing for compliance, hybrid retrieval for evidence anchoring, and proactive personalization through pre-generated insights, all within a fully on-premises financial regulatory environment.

Limitations

- The system's performance is dependent on the availability of enterprise data and internal models.

- The hybrid retrieval approach may have limitations in handling highly dynamic or unstructured financial data.

Future Work

- Enhancing the system's ability to handle real-time data streams for more up-to-date insights.

- Exploring the integration of more advanced contextual bandit algorithms for personalized recommendations.

Paper Details

PDF Preview

Similar Papers

Found 4 papersEnhancing Investment Analysis: Optimizing AI-Agent Collaboration in Financial Research

Neng Wang, Kunpeng Zhang, Sean Xin Xu et al.

AI for Investment: A Platform Disruption

Mohammad Rasouli, Ravi Chiruvolu, Ali Risheh

Comments (0)