Authors

Summary

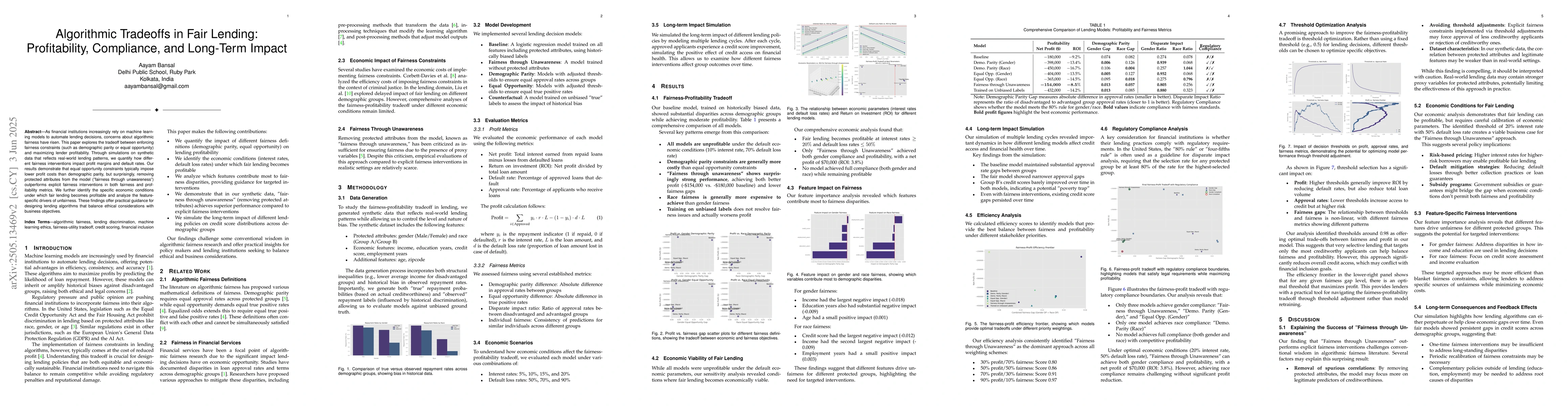

As financial institutions increasingly rely on machine learning models to automate lending decisions, concerns about algorithmic fairness have risen. This paper explores the tradeoff between enforcing fairness constraints (such as demographic parity or equal opportunity) and maximizing lender profitability. Through simulations on synthetic data that reflects real-world lending patterns, we quantify how different fairness interventions impact profit margins and default rates. Our results demonstrate that equal opportunity constraints typically impose lower profit costs than demographic parity, but surprisingly, removing protected attributes from the model (fairness through unawareness) outperforms explicit fairness interventions in both fairness and profitability metrics. We further identify the specific economic conditions under which fair lending becomes profitable and analyze the feature-specific drivers of unfairness. These findings offer practical guidance for designing lending algorithms that balance ethical considerations with business objectives.

AI Key Findings

Generated Jun 08, 2025

Methodology

The research uses simulations on synthetic data reflecting real-world lending patterns to quantify the impact of fairness interventions on profit margins and default rates.

Key Results

- Equal opportunity constraints typically impose lower profit costs than demographic parity in lending decisions.

- Fairness through unawareness (removing protected attributes) outperforms explicit fairness interventions in both fairness and profitability metrics.

- Specific economic conditions were identified under which fair lending becomes profitable.

Significance

This research offers practical guidance for designing lending algorithms that balance ethical considerations with business objectives, crucial as financial institutions increasingly rely on machine learning for automated lending decisions.

Technical Contribution

The paper presents a quantitative analysis of tradeoffs between fairness constraints and profitability in algorithmic lending decisions, identifying fairness through unawareness as an effective strategy.

Novelty

Unlike previous research focusing on either fairness or profitability, this paper uniquely combines both aspects, demonstrating that certain fairness-through-unawareness approaches can be as effective as explicit fairness interventions while maintaining profitability.

Limitations

- The study is based on synthetic data, which may not fully capture all complexities of real-world lending patterns.

- Findings might not generalize to all types of lending institutions or geographical contexts.

Future Work

- Investigate the applicability of findings on diverse, real-world datasets from various lending institutions.

- Explore the long-term impacts of the identified fair lending strategies on market competition and consumer welfare.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrice impact and long-term profitability of energy storage

Roxana Dumitrescu, Peter Tankov, Redouane Silvente

FairHome: A Fair Housing and Fair Lending Dataset

Anusha Bagalkotkar, Gabriel Arnson, Aveek Karmakar et al.

Equalizing Credit Opportunity in Algorithms: Aligning Algorithmic Fairness Research with U.S. Fair Lending Regulation

John P. Dickerson, I. Elizabeth Kumar, Keegan E. Hines

Designing Long-term Group Fair Policies in Dynamical Systems

Patrick Forré, Isabel Valera, Miriam Rateike

No citations found for this paper.

Comments (0)