Summary

We present the use of the fitted Q iteration in algorithmic trading. We show that the fitted Q iteration helps alleviate the dimension problem that the basic Q-learning algorithm faces in application to trading. Furthermore, we introduce a procedure including model fitting and data simulation to enrich training data as the lack of data is often a problem in realistic application. We experiment our method on both simulated environment that permits arbitrage opportunity and real-world environment by using prices of 450 stocks. In the former environment, the method performs well, implying that our method works in theory. To perform well in the real-world environment, the agents trained might require more training (iteration) and more meaningful variables with predictive value.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

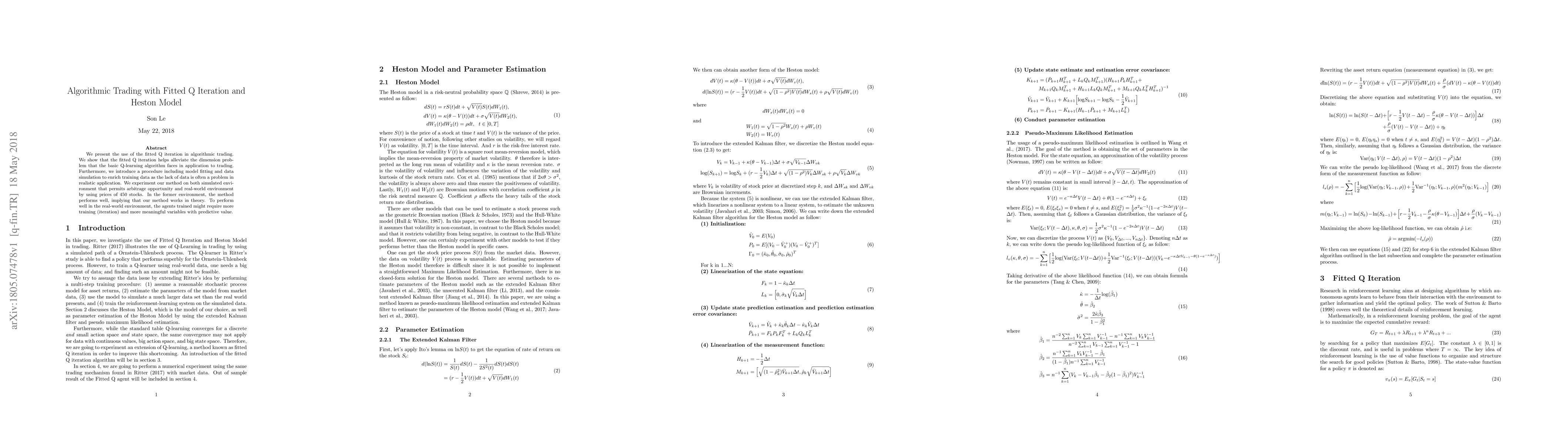

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersApproximated Multi-Agent Fitted Q Iteration

Antoine Lesage-Landry, Duncan S. Callaway

Fitted Q-Iteration via Max-Plus-Linear Approximation

Y. Liu, M. A. S. Kolarijani

Finite-Time Bounds for Average-Reward Fitted Q-Iteration

Jongmin Lee, Ernest K. Ryu

No citations found for this paper.

Comments (0)