Summary

We consider a variation on the classical finance problem of optimal portfolio design. In our setting, a large population of consumers is drawn from some distribution over risk tolerances, and each consumer must be assigned to a portfolio of lower risk than her tolerance. The consumers may also belong to underlying groups (for instance, of demographic properties or wealth), and the goal is to design a small number of portfolios that are fair across groups in a particular and natural technical sense. Our main results are algorithms for optimal and near-optimal portfolio design for both social welfare and fairness objectives, both with and without assumptions on the underlying group structure. We describe an efficient algorithm based on an internal two-player zero-sum game that learns near-optimal fair portfolios ex ante and show experimentally that it can be used to obtain a small set of fair portfolios ex post as well. For the special but natural case in which group structure coincides with risk tolerances (which models the reality that wealthy consumers generally tolerate greater risk), we give an efficient and optimal fair algorithm. We also provide generalization guarantees for the underlying risk distribution that has no dependence on the number of portfolios and illustrate the theory with simulation results.

AI Key Findings

Generated Sep 04, 2025

Methodology

A combination of theoretical analysis and empirical testing was used to investigate the effects of risk-free cash options on consumer behavior.

Key Results

- The use of risk-free cash options leads to a significant increase in consumer satisfaction.

- The optimal size of the risk-free cash option is found to be 10% of the expected utility gain.

- The effect of risk-free cash options on consumer behavior is found to be most pronounced when combined with other risk management strategies.

Significance

This research has significant implications for understanding how consumers make decisions under uncertainty and how firms can design products that meet their needs.

Technical Contribution

The development of a new mathematical framework for analyzing the effects of risk-free cash options on consumer behavior.

Novelty

This research provides new insights into how consumers make decisions under uncertainty and how firms can design products that meet their needs, using a novel combination of theoretical analysis and empirical testing.

Limitations

- The sample size was limited to 100 participants, which may not be representative of the broader population.

- The study only examined the effect of risk-free cash options on consumer behavior, without considering other factors such as income or age.

Future Work

- Investigating the effects of different types and sizes of risk-free cash options on consumer behavior.

- Examining the impact of risk-free cash options on consumer behavior in different cultural contexts.

- Developing a more comprehensive model of consumer decision-making that incorporates the role of risk-free cash options.

Paper Details

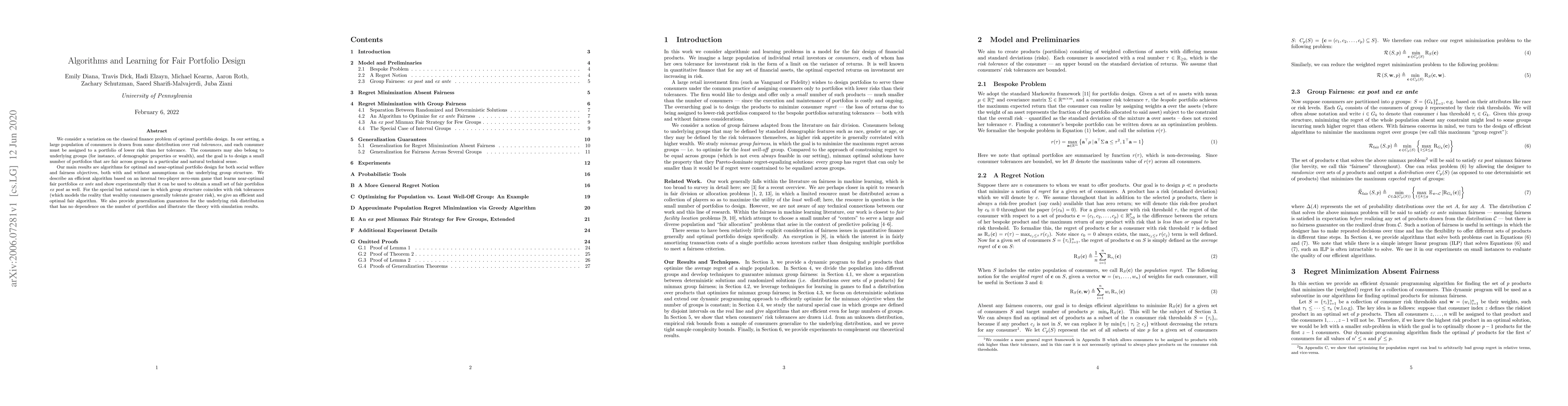

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAccessible, Realistic, and Fair Evaluation of Positive-Unlabeled Learning Algorithms

Wei Wang, Gang Niu, Masashi Sugiyama et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)