Authors

Summary

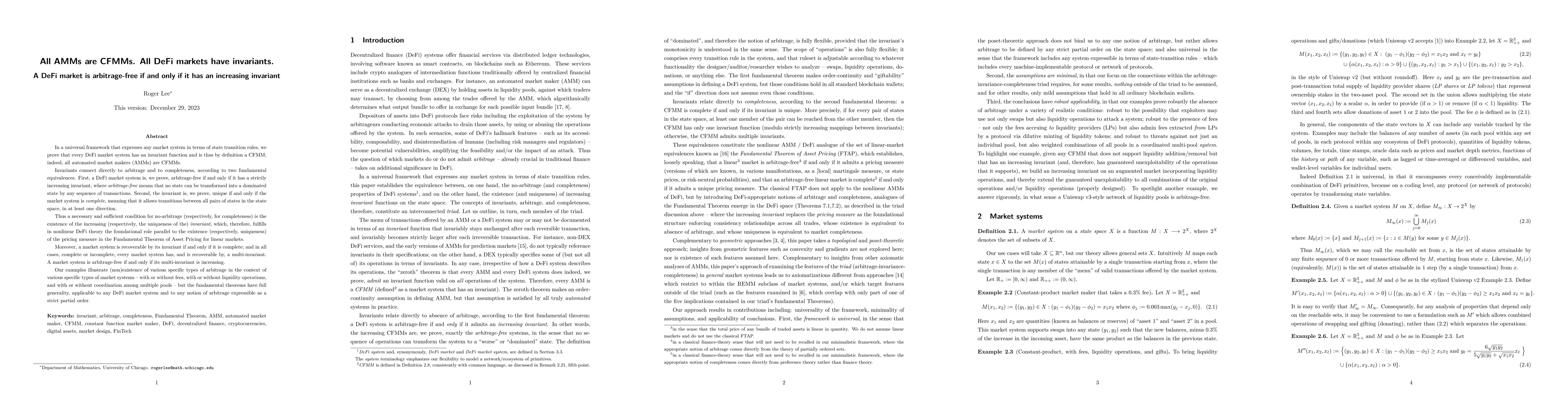

In a universal framework that expresses any market system in terms of state transition rules, we prove that every DeFi market system has an invariant function and is thus by definition a CFMM; indeed, all automated market makers (AMMs) are CFMMs. Invariants connect directly to arbitrage and to completeness, according to two fundamental equivalences. First, a DeFi market system is, we prove, arbitrage-free if and only if it has a strictly increasing invariant, where arbitrage-free means that no state can be transformed into a dominated state by any sequence of transactions. Second, the invariant is, we prove, unique if and only if the market system is complete, meaning that it allows transitions between all pairs of states in the state space, in at least one direction. Thus a necessary and sufficient condition for no-arbitrage (respectively, for completeness) is the existence of the increasing (respectively, the uniqueness of the) invariant, which, therefore, fulfills in nonlinear DeFi theory the foundational role parallel to the existence (respectively, uniqueness) of the pricing measure in the Fundamental Theorem of Asset Pricing for linear markets. Moreover, a market system is recoverable by its invariant if and only if it is complete; and in all cases, complete or incomplete, every market system has, and is recoverable by, a multi-invariant. A market system is arbitrage-free if and only if its multi-invariant is increasing. Our examples illustrate (non)existence of various specific types of arbitrage in the context of various specific types of market systems -- with or without fees, with or without liquidity operations, and with or without coordination among multiple pools -- but the fundamental theorems have full generality, applicable to any DeFi market system and to any notion of arbitrage expressible as a strict partial order.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA theory of Automated Market Makers in DeFi

Massimo Bartoletti, James Hsin-yu Chiang, Alberto Lluch-Lafuente

From banks to DeFi: the evolution of the lending market

Jiahua Xu, Nikhil Vadgama

No citations found for this paper.

Comments (0)