Summary

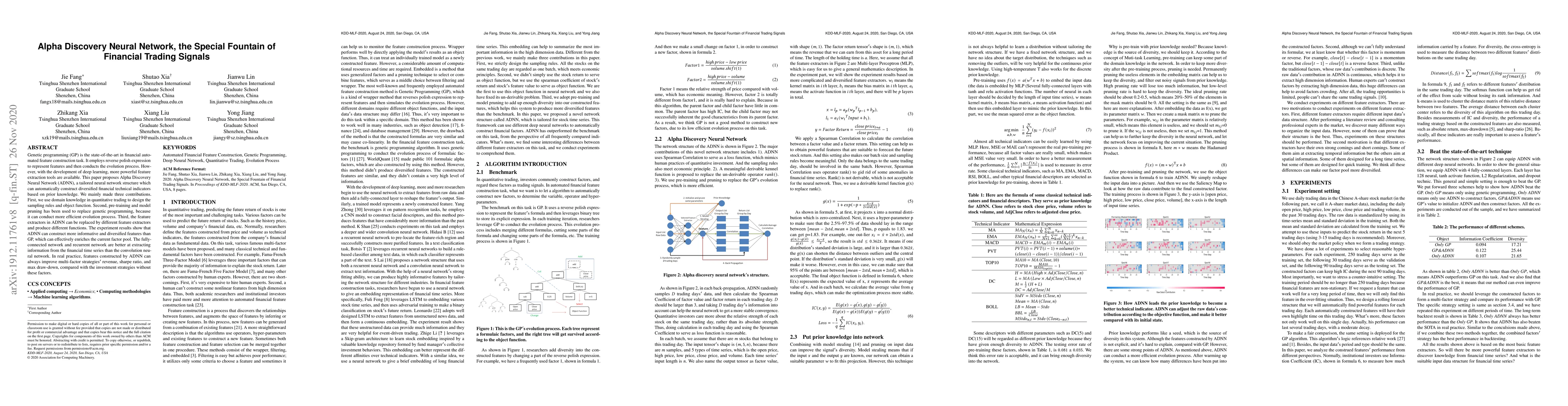

Genetic programming (GP) is the state-of-the-art in financial automated feature construction task. It employs reverse polish expression to represent features and then conducts the evolution process. However, with the development of deep learning, more powerful feature extraction tools are available. This paper proposes Alpha Discovery Neural Network (ADNN), a tailored neural network structure which can automatically construct diversified financial technical indicators based on prior knowledge. We mainly made three contributions. First, we use domain knowledge in quantitative trading to design the sampling rules and object function. Second, pre-training and model pruning has been used to replace genetic programming, because it can conduct more efficient evolution process. Third, the feature extractors in ADNN can be replaced by different feature extractors and produce different functions. The experiment results show that ADNN can construct more informative and diversified features than GP, which can effectively enriches the current factor pool. The fully-connected network and recurrent network are better at extracting information from the financial time series than the convolution neural network. In real practice, features constructed by ADNN can always improve multi-factor strategies' revenue, sharpe ratio, and max draw-down, compared with the investment strategies without these factors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)