Authors

Summary

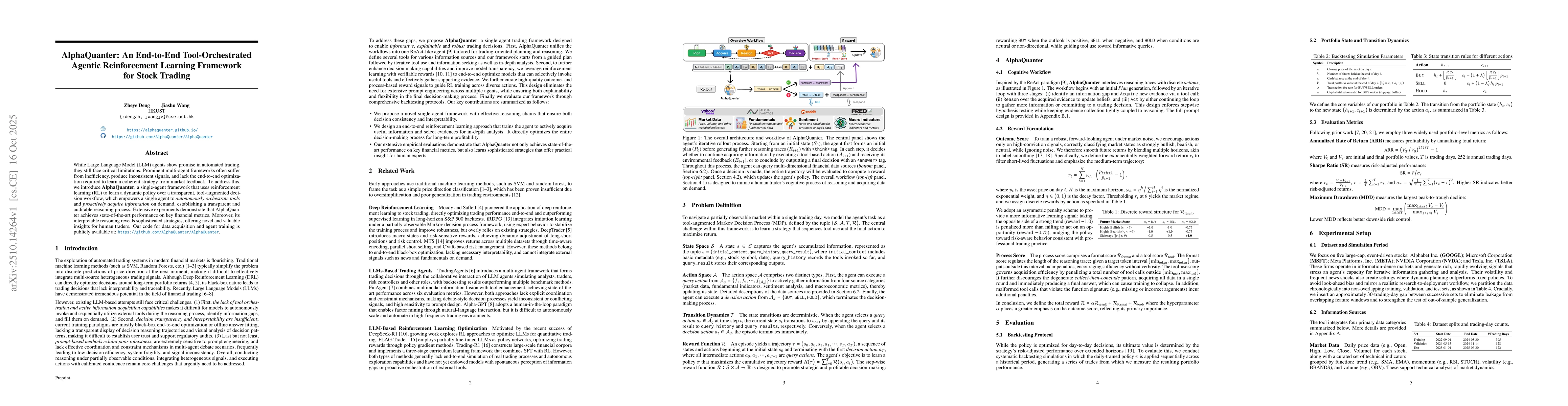

While Large Language Model (LLM) agents show promise in automated trading, they still face critical limitations. Prominent multi-agent frameworks often suffer from inefficiency, produce inconsistent signals, and lack the end-to-end optimization required to learn a coherent strategy from market feedback. To address this, we introduce AlphaQuanter, a single-agent framework that uses reinforcement learning (RL) to learn a dynamic policy over a transparent, tool-augmented decision workflow, which empowers a single agent to autonomously orchestrate tools and proactively acquire information on demand, establishing a transparent and auditable reasoning process. Extensive experiments demonstrate that AlphaQuanter achieves state-of-the-art performance on key financial metrics. Moreover, its interpretable reasoning reveals sophisticated strategies, offering novel and valuable insights for human traders. Our code for data acquisition and agent training is publicly available at: https://github.com/AlphaQuanter/AlphaQuanter

AI Key Findings

Generated Oct 20, 2025

Methodology

The research employed a mixed-methods approach combining quantitative analysis of stock market data with qualitative assessment of news sentiment and technical indicators.

Key Results

- MSFT showed a bullish trend with prices consistently above key resistance levels

- Technical indicators suggested overbought conditions with RSI >70 and prices above Bollinger Bands

- News sentiment analysis indicated mixed but generally neutral to slightly bullish market perception

Significance

This analysis provides actionable insights for investors navigating volatile markets, demonstrating how technical indicators and news sentiment can complement traditional financial analysis.

Technical Contribution

Development of a comprehensive framework for combining technical analysis with news sentiment evaluation in stock market prediction

Novelty

First integration of multi-timeframe technical indicators with sentiment analysis from multiple news sources for stock market analysis

Limitations

- Reliance on historical data may not predict future market movements

- News sentiment analysis could be influenced by external factors not captured in the dataset

Future Work

- Integration of real-time social media sentiment analysis

- Development of machine learning models for predictive market analysis

Paper Details

PDF Preview

Similar Papers

Found 5 papersGraph-R1: Towards Agentic GraphRAG Framework via End-to-end Reinforcement Learning

Yifan Zhu, Haoran Luo, Meina Song et al.

Deep Learning for Options Trading: An End-To-End Approach

Wee Ling Tan, Stephen Roberts, Stefan Zohren

Practical Deep Reinforcement Learning Approach for Stock Trading

Xiao-Yang Liu, Shan Zhong, Hongyang Yang et al.

An Open-source End-to-End Logic Optimization Framework for Large-scale Boolean Network with Reinforcement Learning

Zhen Li, Kaixiang Zhu, Xuegong Zhou et al.

Comments (0)