Summary

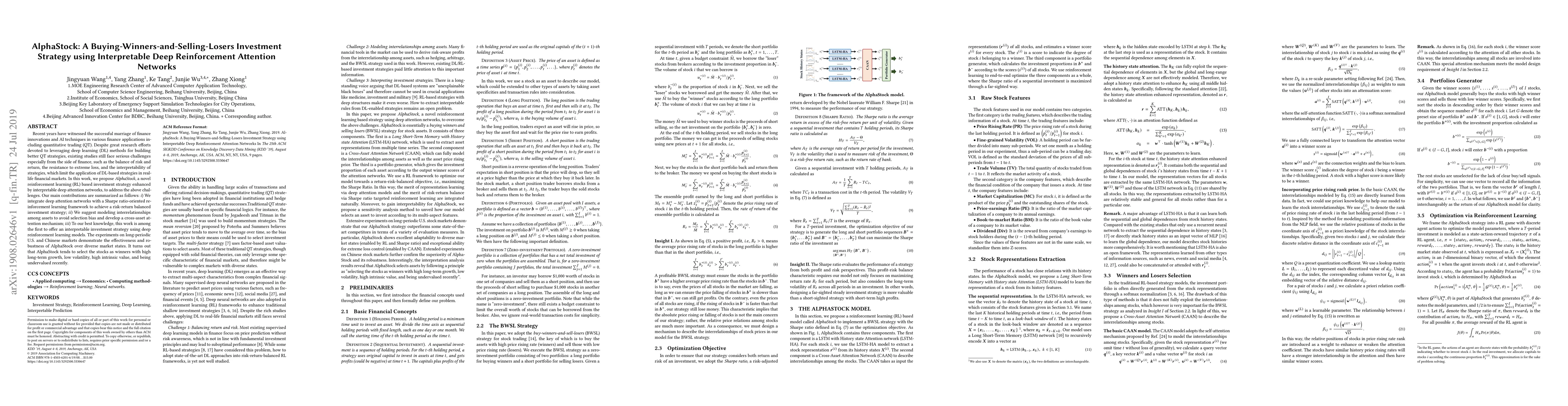

Recent years have witnessed the successful marriage of finance innovations and AI techniques in various finance applications including quantitative trading (QT). Despite great research efforts devoted to leveraging deep learning (DL) methods for building better QT strategies, existing studies still face serious challenges especially from the side of finance, such as the balance of risk and return, the resistance to extreme loss, and the interpretability of strategies, which limit the application of DL-based strategies in real-life financial markets. In this work, we propose AlphaStock, a novel reinforcement learning (RL) based investment strategy enhanced by interpretable deep attention networks, to address the above challenges. Our main contributions are summarized as follows: i) We integrate deep attention networks with a Sharpe ratio-oriented reinforcement learning framework to achieve a risk-return balanced investment strategy; ii) We suggest modeling interrelationships among assets to avoid selection bias and develop a cross-asset attention mechanism; iii) To our best knowledge, this work is among the first to offer an interpretable investment strategy using deep reinforcement learning models. The experiments on long-periodic U.S. and Chinese markets demonstrate the effectiveness and robustness of AlphaStock over diverse market states. It turns out that AlphaStock tends to select the stocks as winners with high long-term growth, low volatility, high intrinsic value, and being undervalued recently.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMTS: A Deep Reinforcement Learning Portfolio Management Framework with Time-Awareness and Short-Selling

Ángel F. García-Fernández, Angelos Stefanidis, Jionglong Su et al.

Pay Attention to What and Where? Interpretable Feature Extractor in Vision-based Deep Reinforcement Learning

Angelo Cangelosi, Tien Pham

| Title | Authors | Year | Actions |

|---|

Comments (0)