Summary

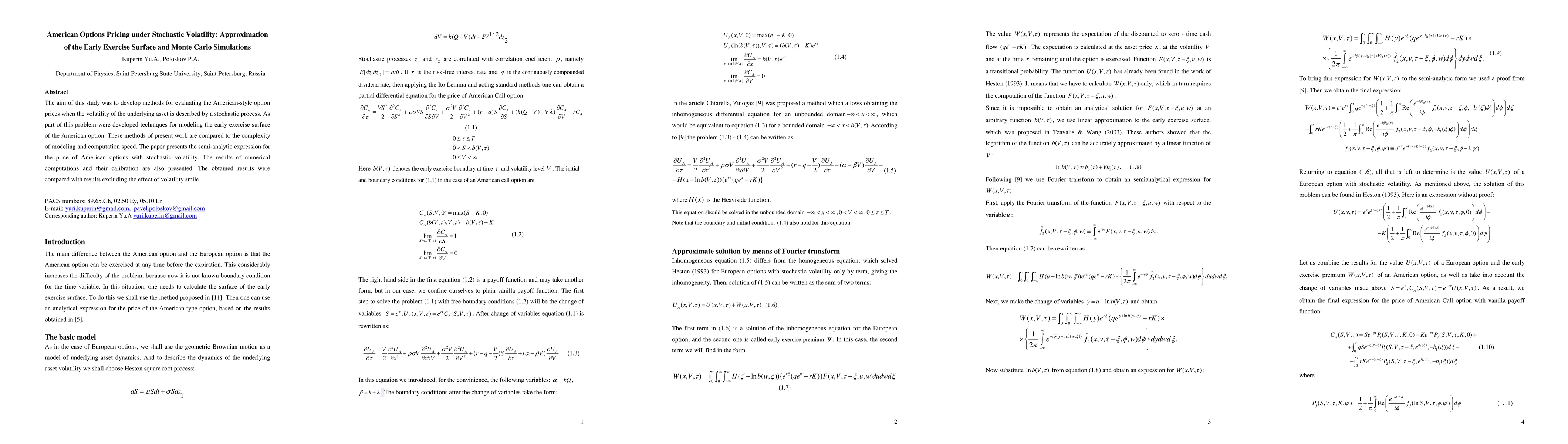

The aim of this study was to develop methods for evaluating the American-style option prices when the volatility of the underlying asset is described by a stochastic process. As part of this problem were developed techniques for modeling the early exercise surface of the American option. These methods of present work are compared to the complexity of modeling and computation speed. The paper presents the semi-analytic expression for the price of American options with stochastic volatility. The results of numerical computations and their calibration are also presented. The obtained results were compared with results excluding the effect of volatility smile.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)