Summary

This paper studies the valuation of a class of default swaps with the embedded option to switch to a different premium and notional principal anytime prior to a credit event. These are early exercisable contracts that give the protection buyer or seller the right to step-up, step-down, or cancel the swap position. The pricing problem is formulated under a structural credit risk model based on Levy processes. This leads to the analytic and numerical studies of several optimal stopping problems subject to early termination due to default. In a general spectrally negative Levy model, we rigorously derive the optimal exercise strategy. This allows for instant computation of the credit spread under various specifications. Numerical examples are provided to examine the impacts of default risk and contractual features on the credit spread and exercise strategy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

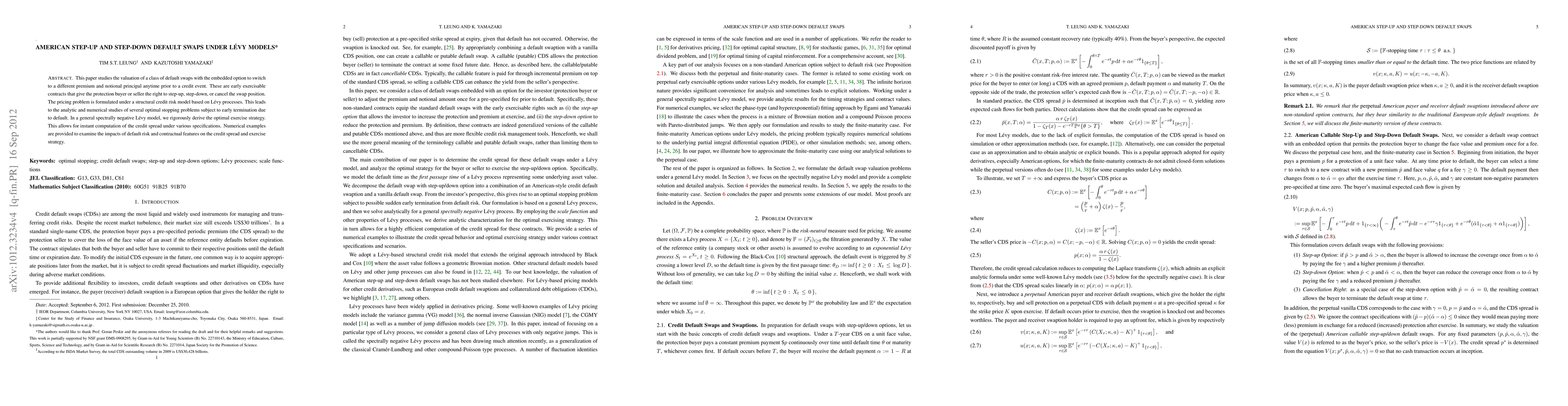

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)