Summary

In this paper we present an efficient active-set method for the solution of convex quadratic programming problems with general piecewise-linear terms in the objective, with applications to sparse approximations and risk-minimization. The method exploits the structure of the piecewise-linear terms appearing in the objective in order to significantly reduce its memory requirements, and thus improve its efficiency. We showcase the robustness of the proposed solver on a variety of problems arising in risk-averse portfolio selection, quantile regression, and binary classification via linear support vector machines. We provide computational evidence to demonstrate, on real-world datasets, the ability of the solver of efficiently handling a variety of problems, by comparing it against an efficient general-purpose interior point solver as well as a state-of-the-art alternating direction method of multipliers. This work complements the accompanying paper [``An active-set method for sparse approximations. Part I: Separable $\ell_1$ terms", S. Pougkakiotis, J. Gondzio, D. S. Kalogerias], in which we discuss the case of separable $\ell_1$ terms, analyze the convergence, and propose general-purpose preconditioning strategies for the solution of its associated linear systems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

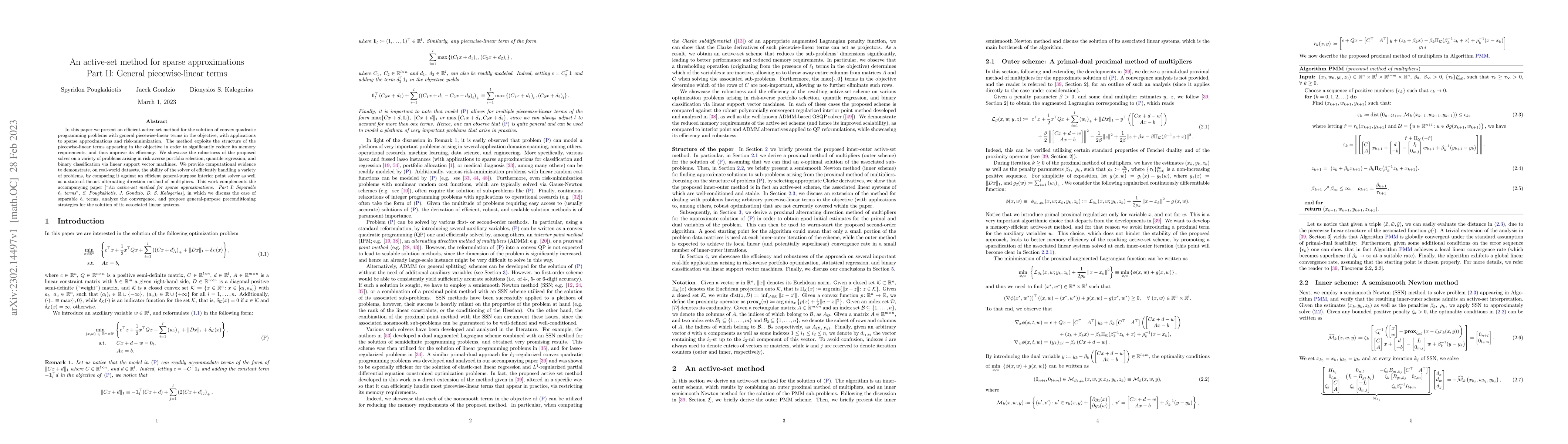

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn active-set method for sparse approximations. Part I: Separable $\ell_1$ terms

Spyridon Pougkakiotis, Jacek Gondzio, Dionysios S. Kalogerias

An efficient active-set method with applications to sparse approximations and risk minimization

Dionysis Kalogerias, Spyridon Pougkakiotis, Jacek Gondzio

| Title | Authors | Year | Actions |

|---|

Comments (0)