Authors

Summary

We derive the first closed-form condition under which artificial intelligence (AI) capital profits could sustainably finance a universal basic income (UBI) without additional taxes or new job creation. In a Solow-Zeira economy characterized by a continuum of automatable tasks, a constant net saving rate $s$, and task-elasticity $\sigma < 1$, we analyze how the AI capability threshold--defined as the productivity level of AI relative to pre-AI automation--varies under different economic scenarios. At present economic parameters, we find that AI systems must achieve only approximately 5-6 times existing automation productivity to finance an 11\%-of-GDP UBI, in the worst case situation where \emph{no} new jobs or tasks are created. Our analysis also reveals some specific policy levers: raising public revenue share (e.g. profit taxation) of AI capital from the current 15\% to about 33\% halves the required AI capability threshold to attain UBI to 3 times existing automotion productivity, but gains diminish beyond 50\% public revenue share, especially if regulatory costs increase. Market structure also strongly affects outcomes: monopolistic or concentrated oligopolistic markets reduce the threshold by increasing economic rents, whereas heightened competition significantly raises it. Overall, these results suggest a couple policy recommendations: maximizing public revenue share up to a point so that operating costs are minimized, and strategically managing market competition can ensure AI's growing capabilities translate into meaningful social benefits within realistic technological progress scenarios.

AI Key Findings

Generated Jun 07, 2025

Methodology

The research uses a Solow-Zeira economy model with a continuum of automatable tasks, constant net saving rate, and task-elasticity less than 1 to derive a closed-form condition for AI capital profit-funded UBI.

Key Results

- AI systems need to achieve 5-6 times existing automation productivity to finance an 11%-of-GDP UBI.

- Raising public revenue share of AI capital to 33% halves the required AI capability threshold to 3 times existing productivity.

- Monopolistic or concentrated oligopolistic markets reduce the threshold by increasing economic rents.

Significance

This research provides insights into how AI-driven economies can sustainably fund UBI, suggesting policy levers to ensure AI progress benefits society.

Technical Contribution

The paper presents a novel closed-form condition linking AI productivity to UBI funding, providing quantifiable thresholds under varying economic scenarios.

Novelty

This work is novel as it's the first to derive such specific conditions for AI capital-funded UBI, offering quantitative insights into policy-making for AI-automated economies.

Limitations

- The model assumes a Solow-Zeira economy which might not fully capture real-world complexities.

- The study doesn't account for potential technological breakthroughs that could alter productivity dynamics.

Future Work

- Investigate the impact of unforeseen technological advancements on AI capability thresholds.

- Explore the implications of this model on diverse economic structures beyond the Solow-Zeira framework.

Paper Details

PDF Preview

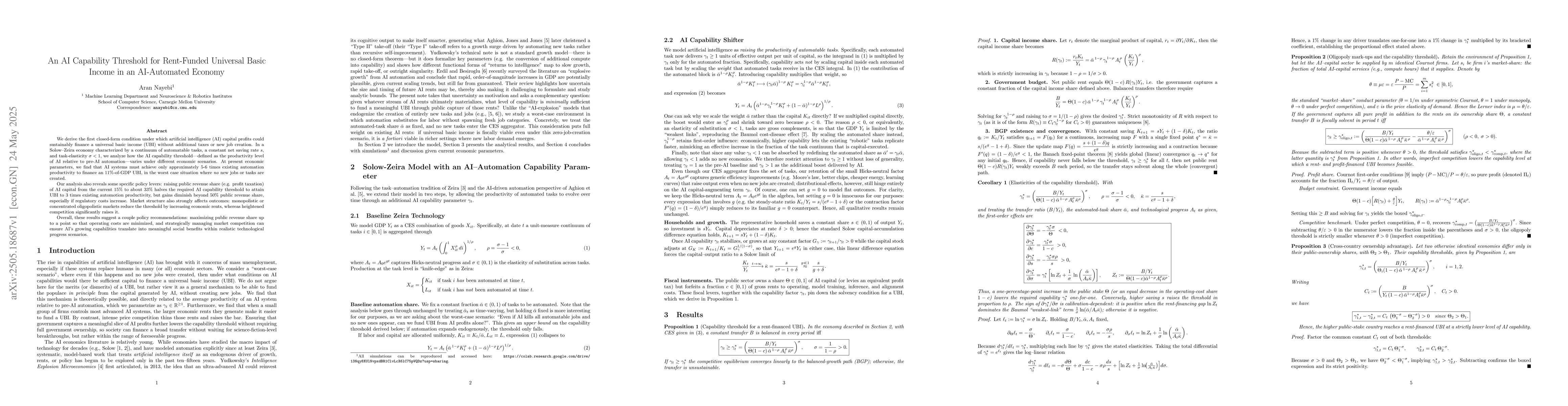

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAI-Enabled Rent-Seeking: How Generative AI Alters Market Transparency and Efficiency

Yukun Zhang, Tianyang Zhang

No citations found for this paper.

Comments (0)