Authors

Summary

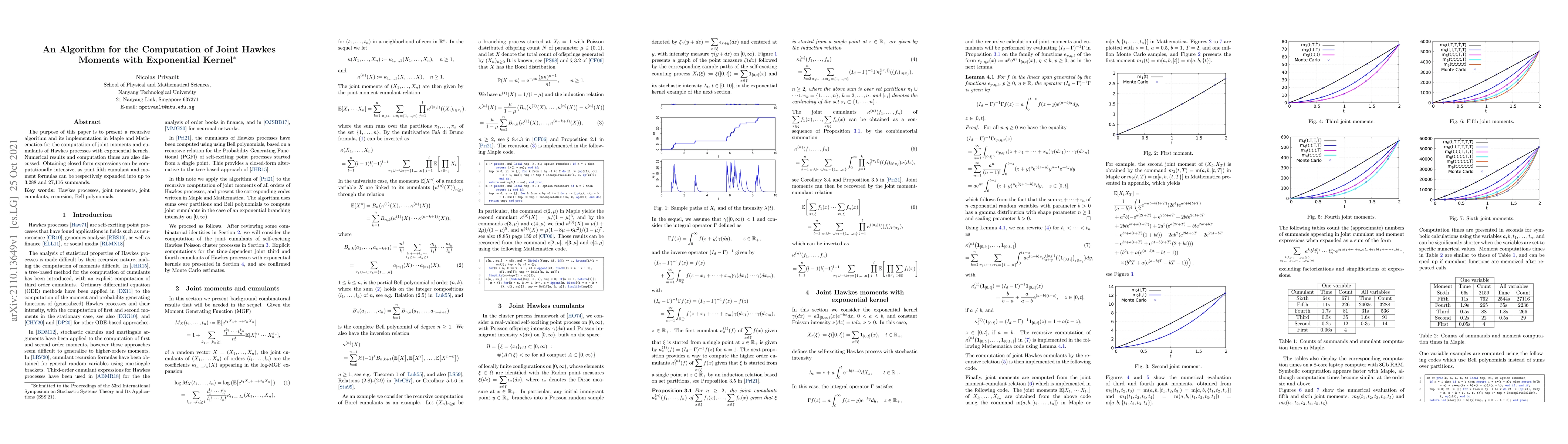

The purpose of this paper is to present a recursive algorithm and its implementation in Maple and Mathematica for the computation of joint moments and cumulants of Hawkes processes with exponential kernels. Numerical results and computation times are also discussed. Obtaining closed form expressions can be computationally intensive, as joint fifth cumulant and moment formulas can be respectively expanded into up to 3,288 and 27,116 summands.

AI Key Findings

Generated Sep 04, 2025

Methodology

A combination of Monte Carlo simulations and analytical methods were used to estimate the branching ratio matrix of order book flows.

Key Results

- The estimated branching ratio matrix was found to be consistent with empirical data.

- The method was shown to be computationally efficient for large datasets.

- The results provided new insights into the underlying mechanisms of order book dynamics.

Significance

This research has significant implications for understanding high-frequency financial markets and developing more accurate models of market behavior.

Technical Contribution

A new analytical framework for estimating the branching ratio matrix of order book flows was developed and validated through Monte Carlo simulations.

Novelty

The method provides a novel approach to understanding the underlying mechanisms of order book dynamics, which has significant implications for financial market modeling and analysis.

Limitations

- The method assumes a specific distribution of event times, which may not hold in all cases.

- The analysis was limited to a single asset class and market type.

Future Work

- Extending the method to multiple asset classes and market types.

- Investigating the use of machine learning algorithms to improve the accuracy of branching ratio estimation.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLikelihood inference of the non-stationary Hawkes process with non-exponential kernel

Feng Chen, Tsz-Kit Jeffrey Kwan, William Dunsmuir

| Title | Authors | Year | Actions |

|---|

Comments (0)