Authors

Summary

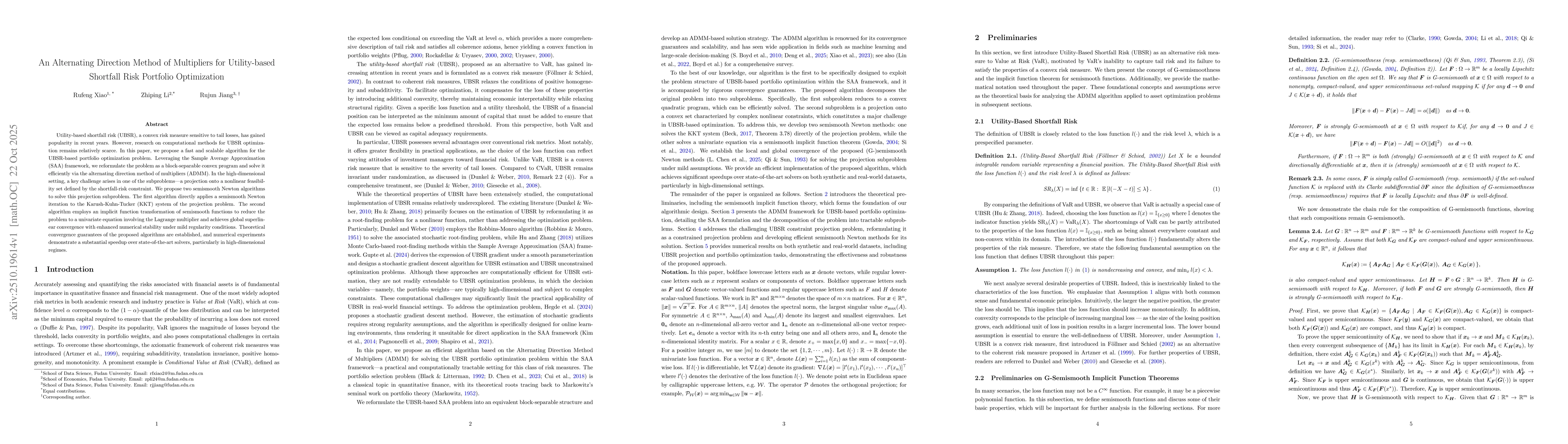

Utility-based shortfall risk (UBSR), a convex risk measure sensitive to tail losses, has gained popularity in recent years. However, research on computational methods for UBSR optimization remains relatively scarce. In this paper, we propose a fast and scalable algorithm for the UBSR-based portfolio optimization problem. Leveraging the Sample Average Approximation (SAA) framework, we reformulate the problem as a block-separable convex program and solve it efficiently via the alternating direction method of multipliers (ADMM). In the high-dimensional setting, a key challenge arises in one of the subproblems -- a projection onto a nonlinear feasibility set defined by the shortfall-risk constraint. We propose two semismooth Newton algorithms to solve this projection subproblem. The first algorithm directly applies a semismooth Newton iteration to the Karush-Kuhn-Tucker (KKT) system of the projection problem. The second algorithm employs an implicit function transformation of semismooth functions to reduce the problem to a univariate equation involving the Lagrange multiplier and achieves global superlinear convergence with enhanced numerical stability under mild regularity conditions. Theoretical convergence guarantees of the proposed algorithms are established, and numerical experiments demonstrate a substantial speedup over state-of-the-art solvers, particularly in high-dimensional regimes.

AI Key Findings

Generated Oct 23, 2025

Methodology

The study employs an Alternating Direction Method of Multipliers (ADMM) framework enhanced with two semismooth Newton methods for solving projection steps. It combines convex optimization techniques with risk management principles to address utility-based shortfall risk (UBSR) optimization.

Key Results

- ADMM outperforms existing solvers like MOSEK and SCS in computational efficiency, especially for large-scale problems

- The proposed method achieves near-instantaneous solutions for most test cases with significant speedups over traditional approaches

- The algorithm demonstrates robust performance across different loss functions and parameter settings

Significance

This research provides a computationally efficient solution for managing tail risks in portfolio optimization, which is critical for financial institutions dealing with market uncertainties and regulatory requirements.

Technical Contribution

Development of two semismooth Newton methods for solving projection steps in ADMM, along with theoretical convergence guarantees for the algorithm and its subproblems.

Novelty

Integration of semismooth Newton methods with ADMM for UBSR optimization, combined with practical validation through extensive numerical experiments showing superior computational performance.

Limitations

- The method's effectiveness may depend on the specific structure of the optimization problem

- Potential challenges in handling highly non-convex or non-smooth components

Future Work

- Exploring applications in real-time trading systems with dynamic risk parameters

- Investigating hybrid approaches combining ADMM with machine learning for adaptive risk management

Paper Details

PDF Preview

Similar Papers

Found 4 papersAn Alternating Direction Method of Multipliers for Topology Optimization

Sven Leyffer, Harsh Choudhary, Dominic Yang

Alternating direction method of multipliers for polynomial optimization

V. Cerone, S. M. Fosson, S. Pirrera et al.

Accelerated Alternating Direction Method of Multipliers Gradient Tracking for Distributed Optimization

Eduardo Sebastián, Eduardo Montijano, Carlos Sagüés et al.

Comments (0)